In the accounting and finance functions of a business, dealing with paperwork is a daily routine. However, this document processing is often tedious and can even be the most time-consuming part, slowing down the entire workflow.

This is where OCR (Optical Character Recognition) steps in, replacing manual document processing with automation. Today, the use of OCR in accounting and finance is becoming one of the key trends to drive operational improvement. OCR is a powerful tool that helps automate data capture from any documents that need to be processed, freeing the team from all the manual hassle.

What is OCR

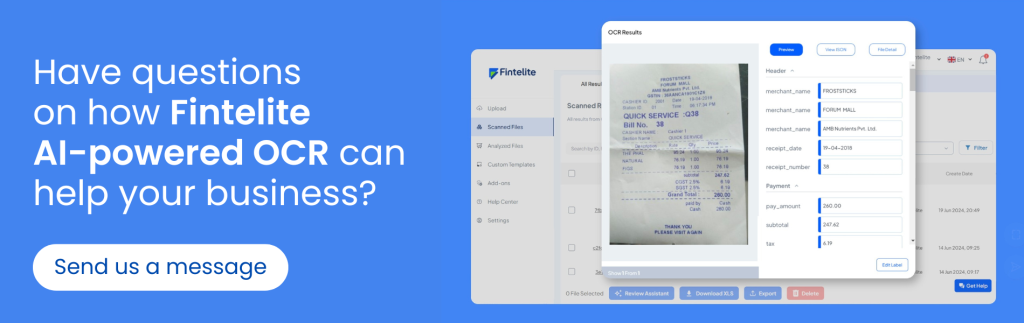

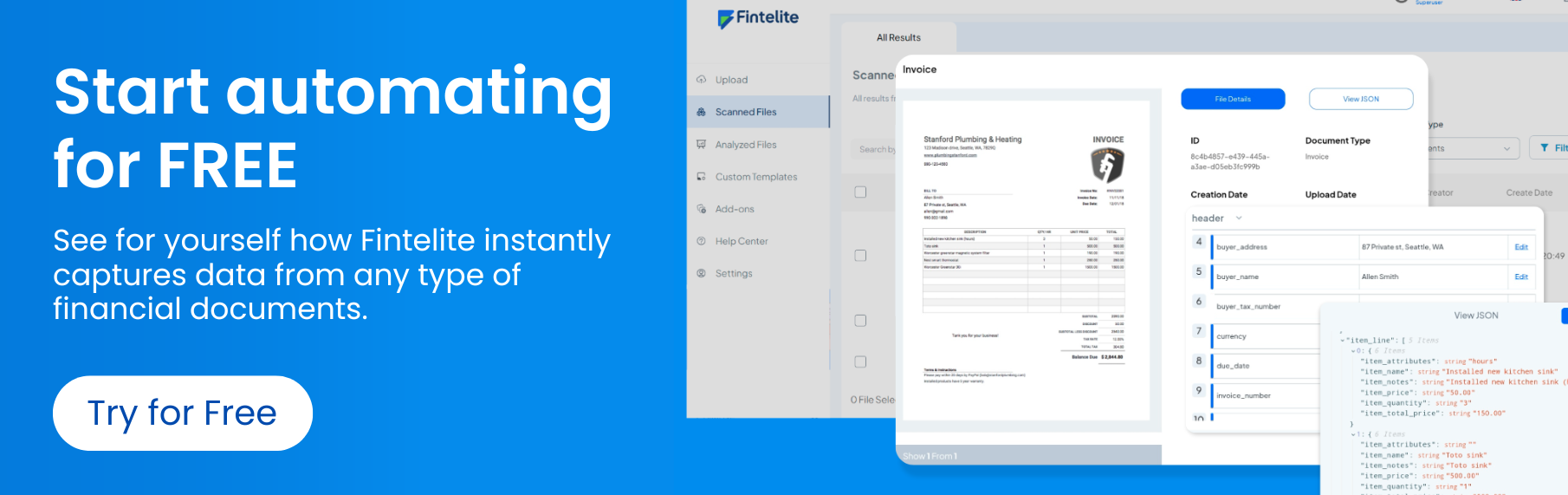

OCR is the process of capturing data from physical or digital documents, and converting them into editable and searchable format. In the accounting and finance workflow, this means you don’t need to manually enter data from invoices or receipts into the system anymore. OCR automates the data extraction process and instantly provide usable data that can be easily transferred to your database.

Ways OCR Accelerates Accounting & Finance Workflow

Managing receipts for expense tracking, processing invoices during accounts payable, and reconciling transactions are all tasks that require high efficiency and attention to detail. In these processes, OCR can be the perfect solution to accelerate data entry and reduce costly errors.

Expense Management

By integrating OCR into how you manage business expense records, the finance team can bid farewell to tedious manual data entry forever. Data from receipts, travel bills, and other purchase documents can be extracted automatically, allowing you to submit expense reports faster.

Accounts Payable

How many invoices do you need to process every day during accounts payable? OCR can help automate invoice handling by extracting details such as vendor names, invoice numbers, amounts, and dates, all instantly. Moreover, the extracted invoice data can also be automatically matched with purchase orders, helping you speed up approval cycles and avoid payment delays.

Bank Reconciliation

Reconciling bank statements with internal transaction records can be overwhelming. OCR simplifies bank reconciliation by capturing transaction history from bank statements and matching it with internal accounting entries. As a result, you can reduce time spent on manual validation and quickly identify discrepancies.

Budgeting

To make effective financial planning, the team always needs accurate data records from multiple sources. In this process, OCR can help pull historical financial data from various documents required automatically, making it faster to consolidate information for budgeting purposes.

Payroll Processing

Approaching the end of the month is always a hectic time to process employee salary payments. To help streamline payroll calculations, OCR can extract employee timesheets and other related documents automatically, helping you to complete salary payment on time.

OCR Benefits to Optimize Accounting and Finance Workflow

OCR can help you unlock a range of benefits that maximize efficiency in your business, especially in the accounting and finance workflow.

Reduce Data Entry Errors

Manual data entry is very susceptible to human error. OCR minimizes these mistakes by automatically capturing data directly from documents with a high level of precision, ensuring data outcomes are always accurate.

Save Time & Efforts

Repetitive tasks like typing, validating, and sorting data are always tiring and time-consuming. OCR takes over these tasks, making them fully automated. Thus, the team can focus on more important tasks instead of paperwork.

Improve Data Accessibility

Data that was once locked in documents can become searchable and editable with OCR. This high accessibility helps the team easily locate specific information, quickly access important data for analysis or other purposes, and share data seamlessly across departments.

Conclusion

Implementing OCR in finance and accounting is not just an upgrade, but a strategic choice if your business wants to maximize efficiency in day-to-day operations. Today, businesses use OCR for finance and accounting in various ways, such as improving expense management, budgeting, accounts payable, reconciliations, and many more.