In this era where access to digital technologies is widespread, attempts at document fraud are significantly increasing. Bank statements are among the documents that are frequently manipulated for unlawful purposes. Such fraudulent cases are becoming more sophisticated, and manual checking is no longer sufficient. Industries such as banking, lending, fintech, and other businesses that regularly deal with bank statements should take effective steps to anticipate this growing risk.

Technologies like AI have introduced new advancements that enable businesses to prevent bank statement fraud more effectively and intelligently. In this article, you will explore the use of AI to detect bank statement fraud, helping your business mitigate potential losses.

Understanding Bank Statement Fraud

Initially, we have to understand emerging trends in bank statement fraud. Whether used to gain access to financing or to qualify for business partnerships, these practices can cause serious impacts for businesses. There are various methods fraudsters use today to manipulate bank statements, such as:

- Manipulating figures or balances to misrepresent financial standing

- Altering transaction amounts or dates

- Editing account balances to inflate or conceal funds

- Removing or adding transactions to change cash flow records

- Modifying bank logos, layouts, or formatting to make documents appear authentic

- Changing account holder information

- Tampering with opening or closing balances

Read also: Red Flags to Watch in Fake Bank Statements

How AI Can Be Used to Detect Bank Statement Fraud

Amidst rising fraud risks, AI technology plays a pivotal role in combating bank statement fraud. The combination of machine learning algorithms and artificial intelligence is powerful to analyze vast financial datasets with high accuracy.

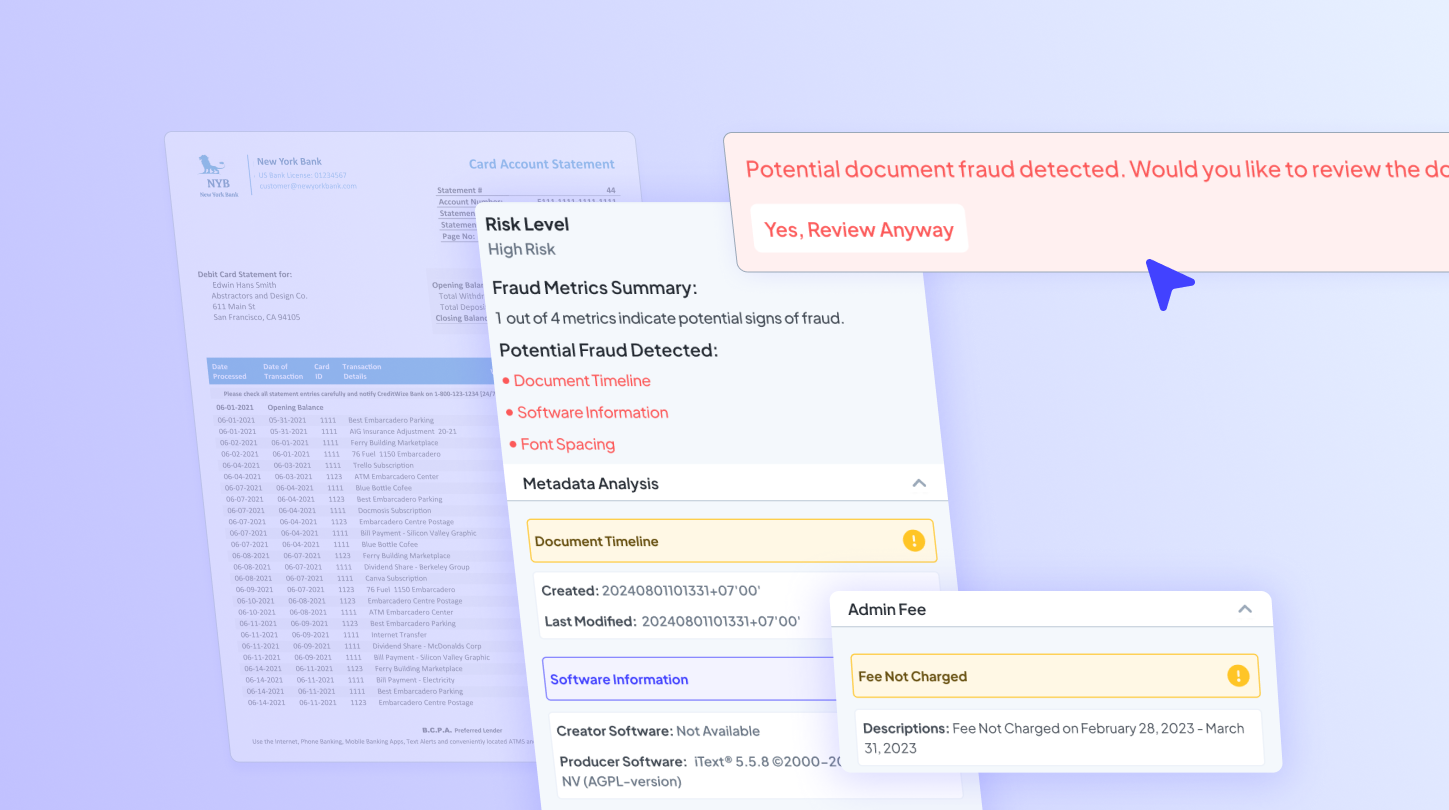

Leveraging advanced tools like Fintelite’s Bank Statement Analyzer can significantly enhance the detection process. With this AI-powered analytic module, this automation enables bank statement underwriters to identify inconsistencies, detect suspicious patterns, and make more informed decisions.

Analyze transaction patterns

Reviewing bank statements in detail takes a lot of time and effort, but now AI turns this into an automated process. Leverage Fintelite’s AI to automatically analyze historical transaction data in bank statements. From these insights, you can quickly assess whether the bank statement owner’s profile or type of business aligns with their financial activity, allowing you to identify potential inconsistencies.

Detect unusual financial activities

Beyond organizing transaction records into a brief summary, AI further flags activities that may indicate fraud or irregular behavior. Fintelite’s AI detects warning signs such as mismatched balances, non-standard administrative charges, unusual ATM withdrawals, or business-related spending on weekends, helping you raise concerns early and take action with confidence.

Identify signs of digital alterations

Digitally manipulated documents are difficult to detect with the human eye. Fintelite’s AI analyzes document forensic, including visual and structural elements, for comprehensive fraud check. This document forensic analysis enables underwriters and credit analysts to uncover digital signs of document tampering that were often missed during manual review.

Solution: Fintelite AI’s Analyzer for Smarter Decisions

In conclusion, the ability to detect and prevent bank statement fraud is non-negotiable. By integrating Fintelite’s advanced Bank Statement Analyzer into the customer risk assessment workflow, businesses can improve both analysis efficiency and their defense against fraud.Ready to enhance your bank statement fraud prevention? Jadwalkan Demo with our AI expert on bank statement analysis automation.