We are not surprised by fraud in this day and age since we have seen so many fraud-related issues, particularly with documents. One example is medical invoice fraud, where fraudsters create fake invoices for their own benefit, causing financial losses for businesses. Industries most affected include health insurance companies and hospitals, as fraudulent claims lead to unnecessary payouts and operational inefficiencies. In this article, we’ll help you identify fake medical invoices and provide methods to avoid falling victim to fraud.

What is Medical Invoice

A medical invoice is similar to a general invoice but specifically details healthcare-related expenses. It serves as an official document issued by hospitals, clinics, or healthcare providers to bill patients or insurance companies.

A medical invoice typically includes:

– Patient details (name, ID, insurance information)

– Medical treatments

– Medications and medical supplies provided

– Service cost and payment information

Medical invoices are essential in insurance claims, medical reimbursements, and financial records for both patients and healthcare providers.

Common Types of Medical Invoice Scams

1. Fake Patient Information

Fraudsters often modify patient details to make fake invoices appear legitimate. Incorrect names, medical IDs, or insurance information can be used to trick companies into processing false claims.

2. Duplicate Charges

This occurs when the same service is billed multiple times, intentionally or due to errors. If invoices are not carefully reviewed, businesses or insurers may overpay for treatments that were only provided once, leading to financial losses.

3. Incorrect Quantity or Services

Similar to fake patient information, this type of fraud involves billing for extra treatments or medications that were never provided. Since the invoice does not reflect actual services, companies end up paying more than necessary.

Methods to Spot a Fake Medical Invoice

There are two main methods for detecting fake medical invoices: manual reviewing and AI-powered verification.

1. Manual Reviewing

Companies can manually check each medical invoice by comparing transaction details with actual medical records. This includes carefully evaluating discrepancies in patient names or IDs, as well as the correctness of treatment dates and service descriptions.

While this method can help spot fraud, it is time-consuming and inefficient. It requires multiple reviews to cross-check data, leading to delays in processing insurance claims and potential dissatisfaction among patients awaiting reimbursements.

2. Using AI Technology

Unlike manual reviews that rely on human effort, AI-powered solutions automate the verification process. With AI, companies can simply upload the documents and have them processed and checked by an AI-integrated system. The ability to analyze data quickly and accurately. Additionally, any irregularities in the document will be instantly detected. This strategy saves time and decreases fraud risk.

How Fintelite OCR Spots Fake Medical Invoices

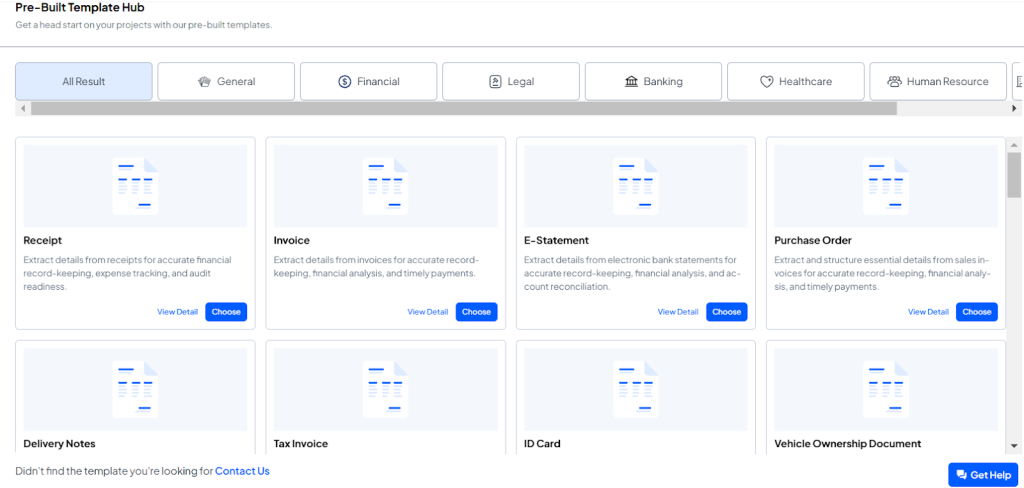

Fintelite OCR is a powerful solution for detecting fake medical invoices, assisting businesses in combating fraud with high-speed processing and accuracy. Its user-friendly dashboard contains a medical invoice template, allowing employees to easily handle documents without any training.

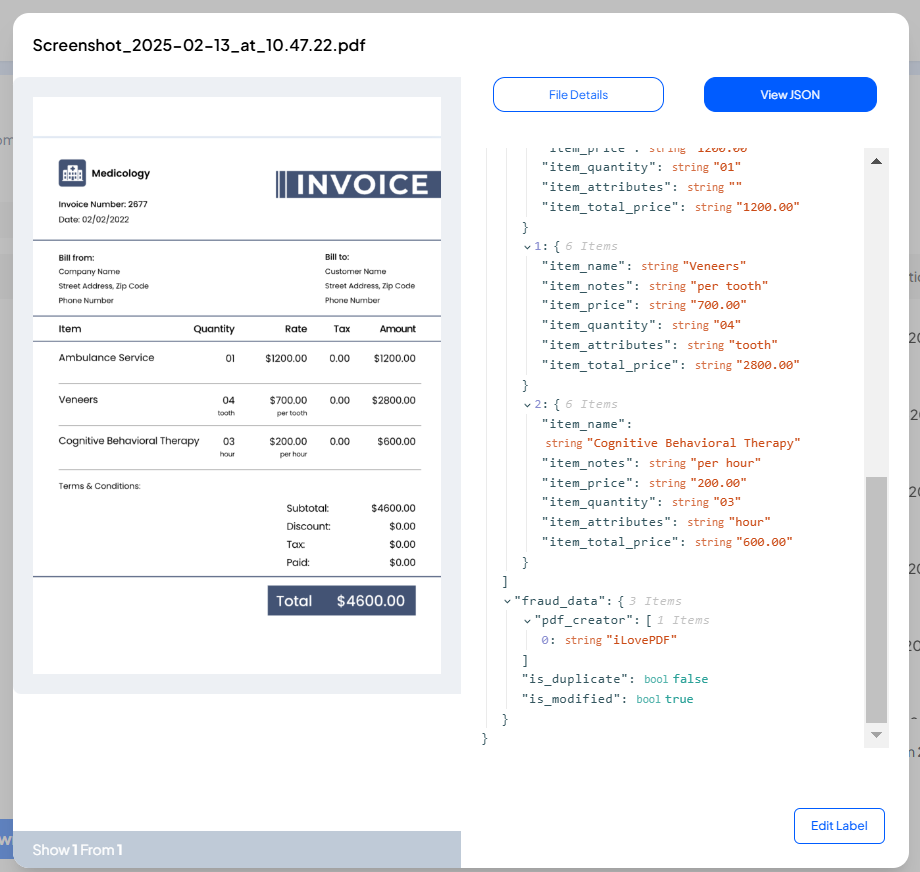

With the ability to process invoices 10 times faster and achieve 90% accuracy, Fintelite OCR ensures a high level of fraud detection. It can detect fraudulent fields, such as changed or modified data from an edited platform. It also detects anomalies such as duplicate charges or incorrect patient details and assesses fraud risk levels by highlighting suspicious invoices.

By automating the verification process, Fintelite OCR helps businesses make informed decisions, reduce financial losses, and improve operational efficiency, making it a reliable tool for fraud prevention.

That is the explanation and tips on how to spot fake medical invoices. AI technology has proven to be the most effective solution for detecting fraud in medical invoice. With Fintelite OCR, businesses can streamline the verification process, reduce errors, and prevent financial losses. As one of the best tools available, Fintelite provides everything you need to combat fraud efficiently in today’s digital era.