As insurance companies grow over time, the growing volume of claim submission demands more efficient document processing and management. Manually verifying incoming claim documents, such as forms and invoices, is a time-consuming process that often delays approval. This is where insurance companies should adopt technologies like OCR (Optical Character Recognition) to accelerate the way they handle claims. OCR can help them automate data capture from scanned documents and digital files received from policyholders. This way, overall insurance operations can be both accelerated and streamlined, resulting in improved insurance experience.

In this article, we will discuss how OCR technology can be used to help insurance companies, particularly in claims processing. We will also delve deeper into the benefits and several considerations when implementing it.

Introduction to OCR

OCR (Optical Character Recognition) is a technology designed to extract data from documents or images, converting it into a machine-readable format that computers can easily process. To put it into practice, information in a scanned document, for example, can be automatically pulled out and generated into structured digital data. With this capability, OCR has significantly transformed document processing across various industries. In insurance, it can help improve claims processing efficiency by automating data intake from various documents that need to be reviewed.

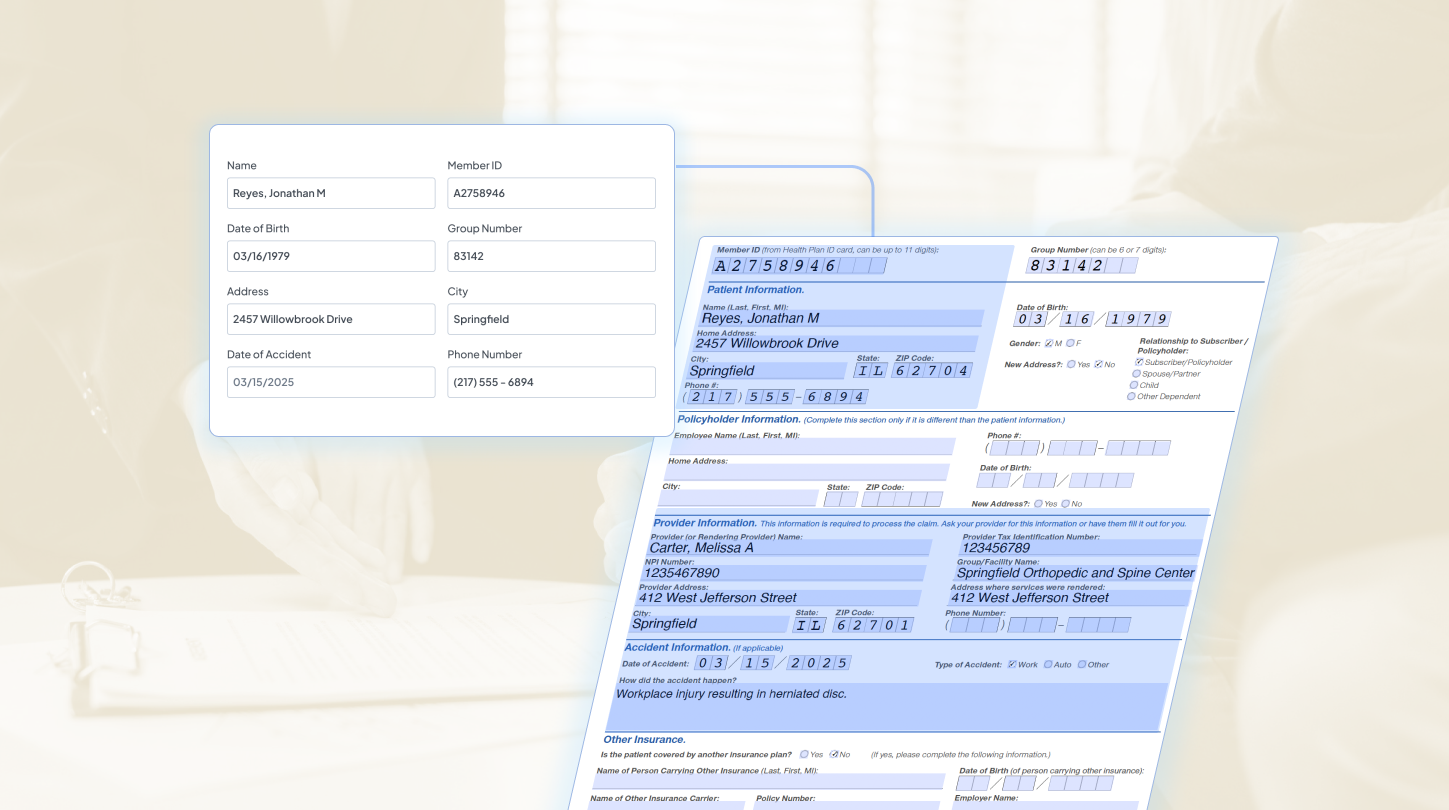

How OCR Works in Claims Processing

Now that we have discussed the definition of OCR technology, here are several key steps of how it works in processing claim documents.

1. Document Capture

Documents are first captured through scans or digital uploads, such as claim forms, medical reports, invoices, and supporting documents submitted by policyholders. Clear and high-resolution images are essential to ensure accurate text recognition.

2. Intelligent Data Extraction

OCR then analyzes the captured documents and automatically extracts key insurance data, including policyholder information, policy numbers, claim details, medical records, and billing information. This process runs automatically in minutes.

3. Data Structuring and System Integration

The extracted information is then organized into structured fields and can be seamlessly integrated into claims management systems or databases for further claim handling and reporting.

Types of Claim Documents OCR Can Process

With AI advancing its capabilities, modern OCR can now seamlessly extract data from any type of claim documents insurance often deals with, such as:

- Claim Forms: Standard forms submitted by policyholders containing personal, policy, and claim-related information.

- Bills: Documents issued by service providers detailing costs for medical treatment, repairs, or services.

- Medical Reports: Health insurance involves clinical documents that support health insurance claims with diagnosis and treatment details.

- Proof of Payment: Receipts and transaction records that verify expenses already paid by the claimant.

- Other documentation: Supporting materials such as identity documents, accident reports, photos, or others that provide additional information needed for claims.

Top Benefits of OCR in Claims Processing

Implementing OCR automation into claims processing workflow introduces substantial time savings and operational efficiencies. Below are the benefits that make OCR the best solution for insurance:

Reduce delays and errors

If claims processing still heavily relies on manual data entry from a large volume of documents, it can hinder operational efficiency and slow down claim approvals. OCR eliminates these bottlenecks by automatically capturing key information from all documents and feeding it directly into your system.

Faster claims verification

Before claim approval, underwriters need to assess claim eligibility based on relevant proofs and supporting documents. With OCR automating data capture, they can collect all the necessary information faster and verify documents more efficiently than before.

Improve customer experience

Not only will OCR bring operational benefits for the company, but it also benefits the customer side. From more efficient administration to shortened waiting times for disbursement, these improvements collectively contribute to enhanced customer satisfaction.

Conclusion: Streamline Claims Processing with Fintelite AI OCR

Fintelite stands as a scalable AI OCR solution designed for businesses and enterprises. Seamlessly integrate Fintelite AI OCR to speed up data collection from various claim documents, enabling information to be extracted and converted into structured datasets compatible with your system. With our configurable OCR module, easily customize tailored data extraction rules to match your existing database fields. Jadwalkan Demo to see how Fintelite AI OCR works for your specific business needs.