In the fast-paced digital landscape, where transactions occur with a mere click, the specter of bank statement fraud casts a significant shadow for loan underwriting or mortgage analyser. As transactions become more seamless, the risks associated with bank statement fraud increase. This article is dedicated to unraveling the complexities of bank statement fraud detection—an essential skill for safeguarding financial integrity. We’ll explore the nuances of recognizing red flags, leveraging advanced technologies, and staying ahead in the relentless pursuit of securing your financial well-being.

Understanding Bank Statement Fraud Detection

Bank statement fraud encompasses a range of deceptive practices aimed at manipulating financial records for illicit gains. From identity theft to unauthorized transactions, fraudsters employ various tactics to exploit vulnerabilities in the financial system. Recognizing the types and methods of bank statement fraud is the first step in building a robust defense.

Common Indicators of Bank Statement Fraud Detection

Prompt bank statement fraud detection is crucial for minimizing potential damages. Some common indicators of bank statement fraud include irregular transactions, unexpected withdrawals, or discrepancies in account balances. By regularly monitoring these indicators, individuals and businesses can identify potential threats and take prompt action. For an example, ATM withdrawal and payment on the weekend should raise concerns.

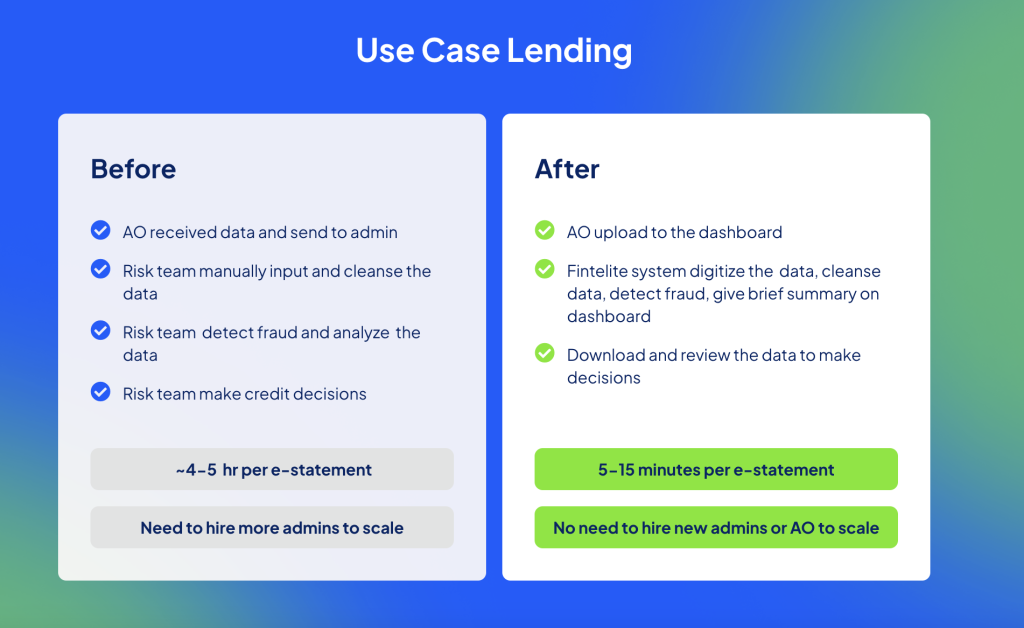

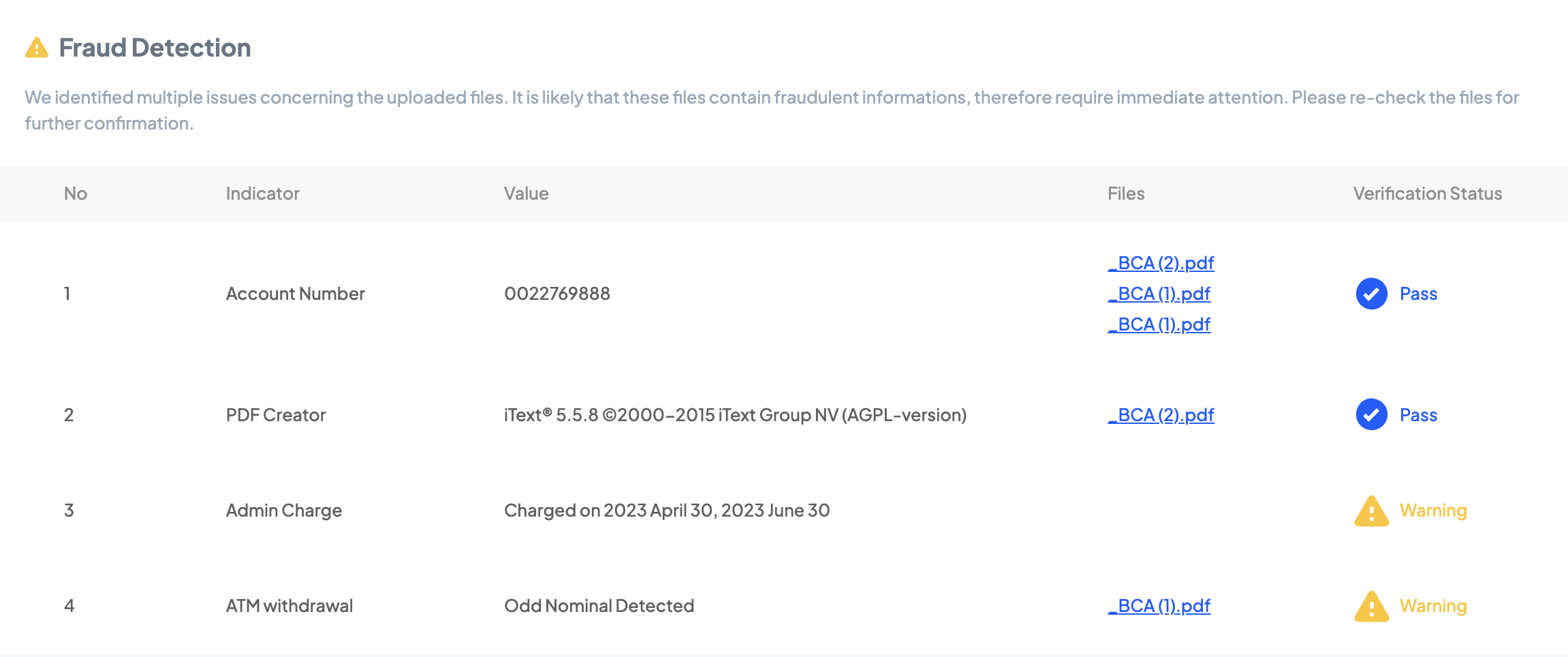

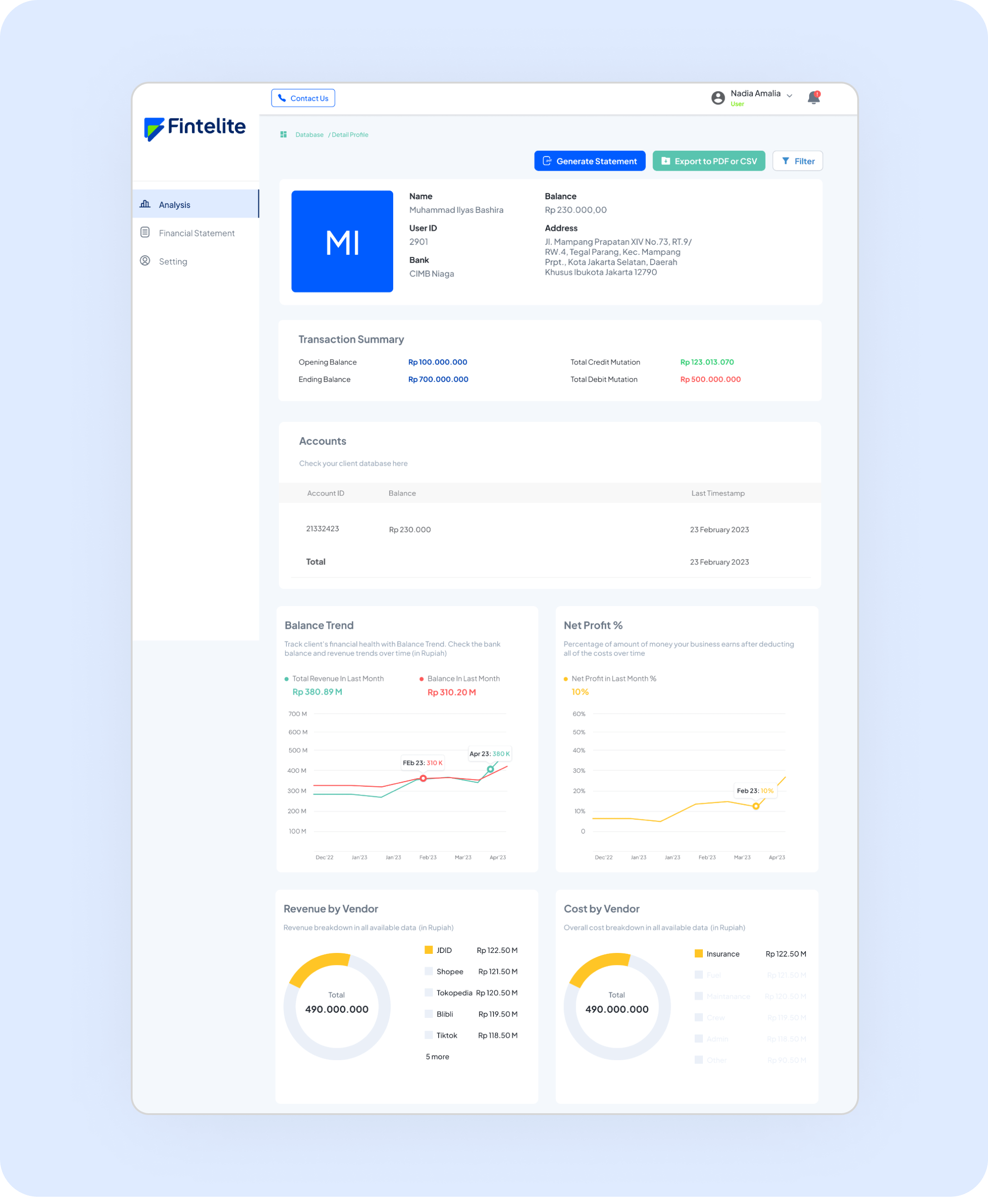

AI powered technology, such as Fintelite’s Penganalisa Bank Statement, manages to detect Account Number irregularities, edited PDF detection, Admin Charge irregularities, and ATM withdrawal risks. This tool will help analyst to detect fraud from bank statement 10x faster than manual tools.

Leveraging Technology for Bank Statement Fraud Detection

In the digital era, technology plays a pivotal role in combating bank statement fraud. Advanced fraud detection tools utilize machine learning algorithms and artificial intelligence to analyze patterns, identify anomalies, and flag suspicious transactions. Integrating these technologies into your financial security measures can significantly enhance fraud prevention efforts.

Leveraging advanced tools such as Fintelite’s Bank Statement OCR can significantly enhance the detection process. This technology automates the extraction of crucial data, enabling underwriters to focus on scrutinizing the information for irregularities.

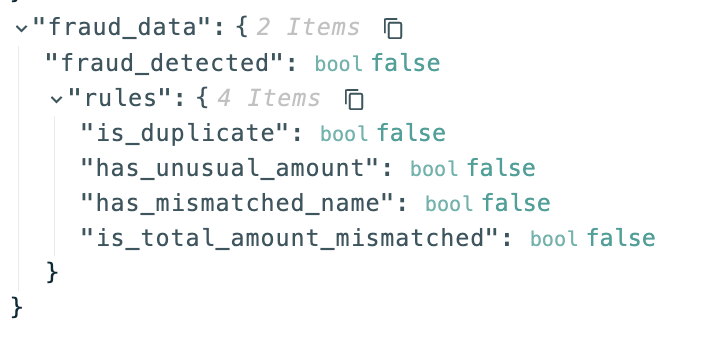

Fintelite OCR Bank Statement Fraud Detection can scan for suspicious duplicate amount, mismatched name across pages, and total amount mismatched.

Analyzing Transaction Trends

A loan underwriter must dive deep into the transactional history presented in bank statements. Fintelite’s Penganalisa Bank Statement empowers underwriters to analyze transaction trends comprehensively. This tool not only aids in identifying anomalies but also provides a holistic view of the borrower’s financial behavior, facilitating a more accurate risk assessment.

Continuous Learning and Adaptation

Bank statement fraud tactics evolve, and as a loan underwriter, staying ahead of these changes is crucial. Continuous learning about emerging fraud trends, attending training programs, and staying updated on the latest detection technologies ensure that underwriters are well-equipped to face the challenges posed by ever-evolving fraudulent practices.

In the dynamic landscape of loan underwriting, the ability to detect and prevent bank statement fraud is non-negotiable. By combining a discerning eye, advanced technologies like Bank Statement OCR and Penganalisa Bank Statement from Fintelite, and a commitment to continuous learning, loan underwriters can fortify their defenses.

Ready to enhance your fraud detection capabilities? Try Fintelite for Free or Consult with our AI expert on AI-powered bank statement fraud detection. Your financial security is just a click away!