AI-Powered Solutions for Your Business

Turn Any Document into a Clean Data in Minutes

No complex setup. Just upload your PDFs

or scans, tell Fintelite what data you need

in plain English, and get an instant Excel

or API export.

END-TO-END AUTOMATION

How It Works?

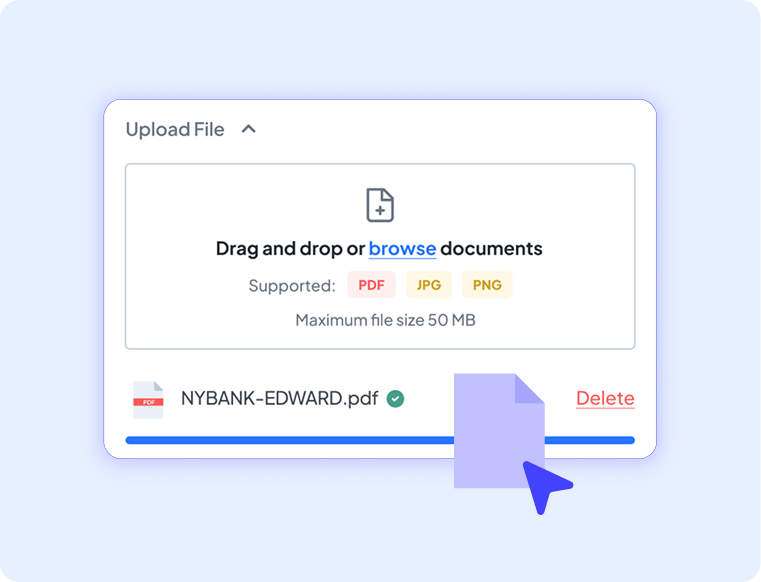

Upload

Drag and drop any unstructured document—payslips, invoices, bank statements, or messy scans. We handle the heavy lifting of OCR.

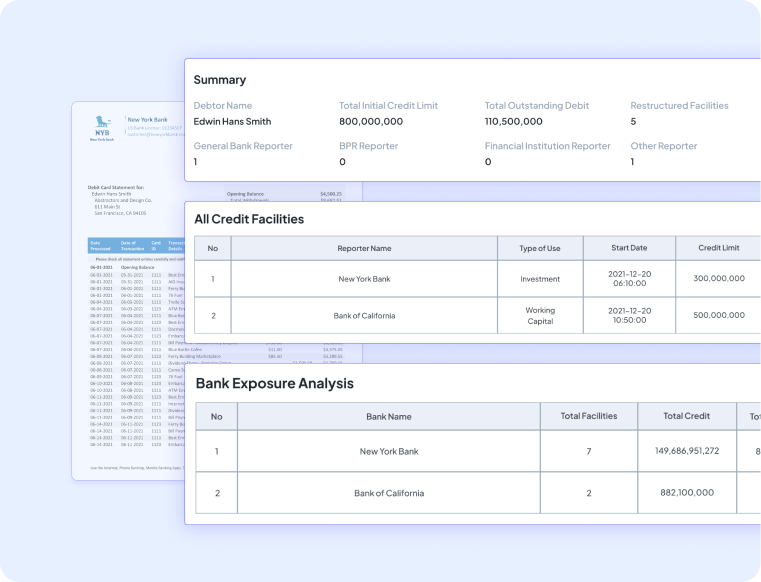

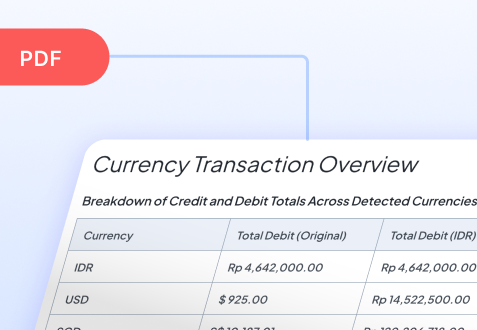

Extract and Enrich

Type what you’re looking for. Example: “Extract the total tax amount and all line items.” Our AI understands context, not just characters or templates

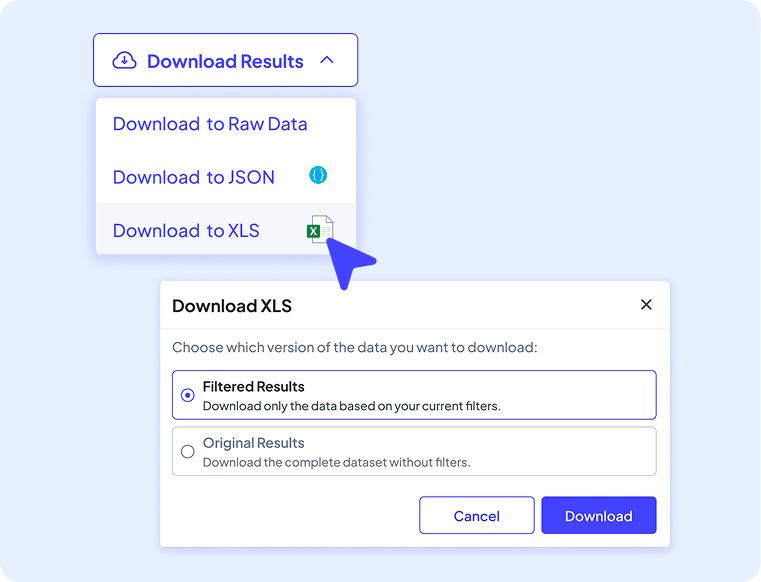

Export

Download your data as a clean Excel sheet or connect via our developer-friendly API for your technical stack.

Why Fintelite Beats Traditional OCR

95%+ Extraction

Accuracy

Powered by Generative IDP that understands document variations.

Zero-Template

Setup

Unlike legacy systems that take weeks to “train” a template, Fintelite works out of the box for any layout.

Enterprise-Grade

Security

ISO 27001 compliant and end-to-end encryption. Your data is processed securely with flexible deployment options (Saas to On-premise).

Proven Impact

Across Industries

88.3%

Average reduction in manual effort

3.5x

Median ROI over a 6-month payback period

2-3x

Faster setup time than industry standards

Proven Impact

Across Industries

88.3%

Average reduction in manual effort

3.5x

Median ROI over a 6-month payback period

2-3x

Faster setup time than industry standards

Designed to Meet

Various Business Needs

Because document processing

should be simple, streamlined

and automated—not manual.

For Business Teams

From PDF to Pivot Table

in Seconds

Stop the manual data entry and review. Whether it’s a stack of 500 invoices or messy employee payslips, just upload them and tell Fintelite what you need. Get a perfectly formatted Excel file ready for your monthly report.

For IT Team

The API That Doesn't Break

Stop wasting months training models for every new document layout. Use our parsing to predict endpoint to get structured JSON with high confidence scores.

Proven Use Cases

Accross Industries

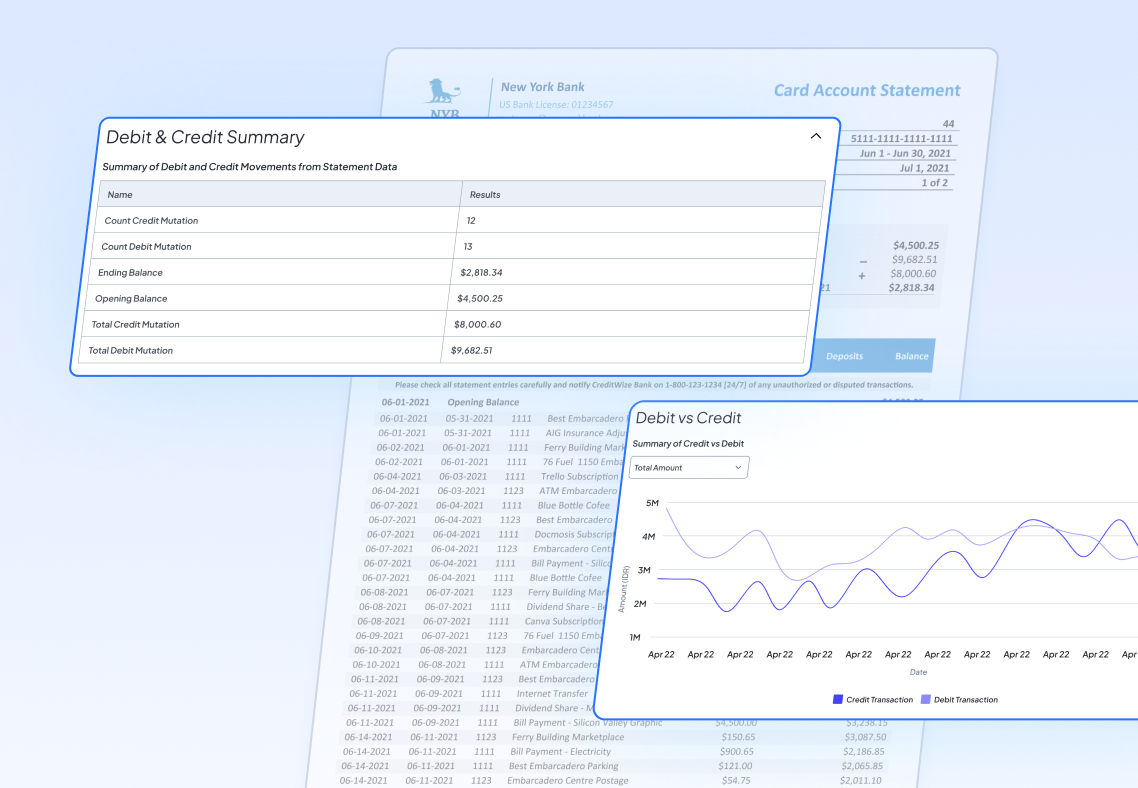

Banking & Lending

Accelerate “Document-to-Decision” Automate credit underwriting by instantly extracting data from bank statements, financial statements to loan forms. Shorten your approval cycle from days to minutes

with high-accuracy data ingestion.

Banking & Lending

Accelerate “Document-to-Decision” Automate credit underwriting by instantly extracting data from bank statements, financial statements to loan forms. Shorten your approval cycle from days to minutes with high-accuracy data ingestion.

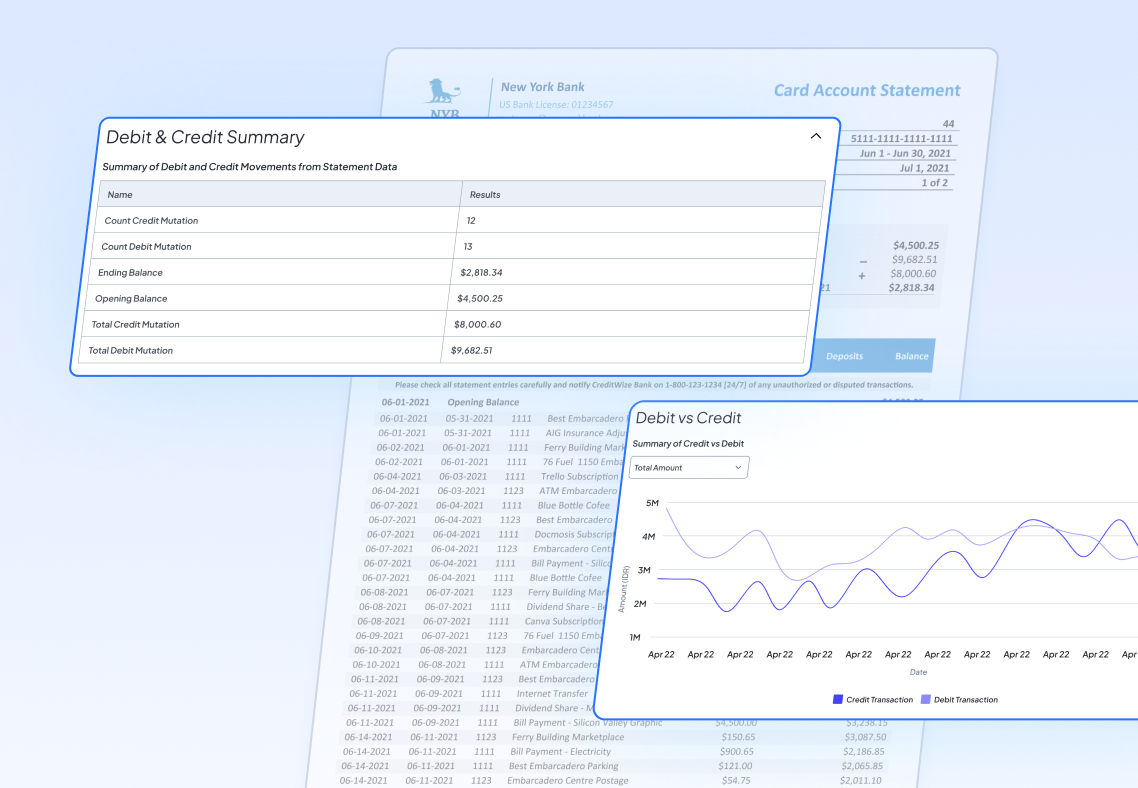

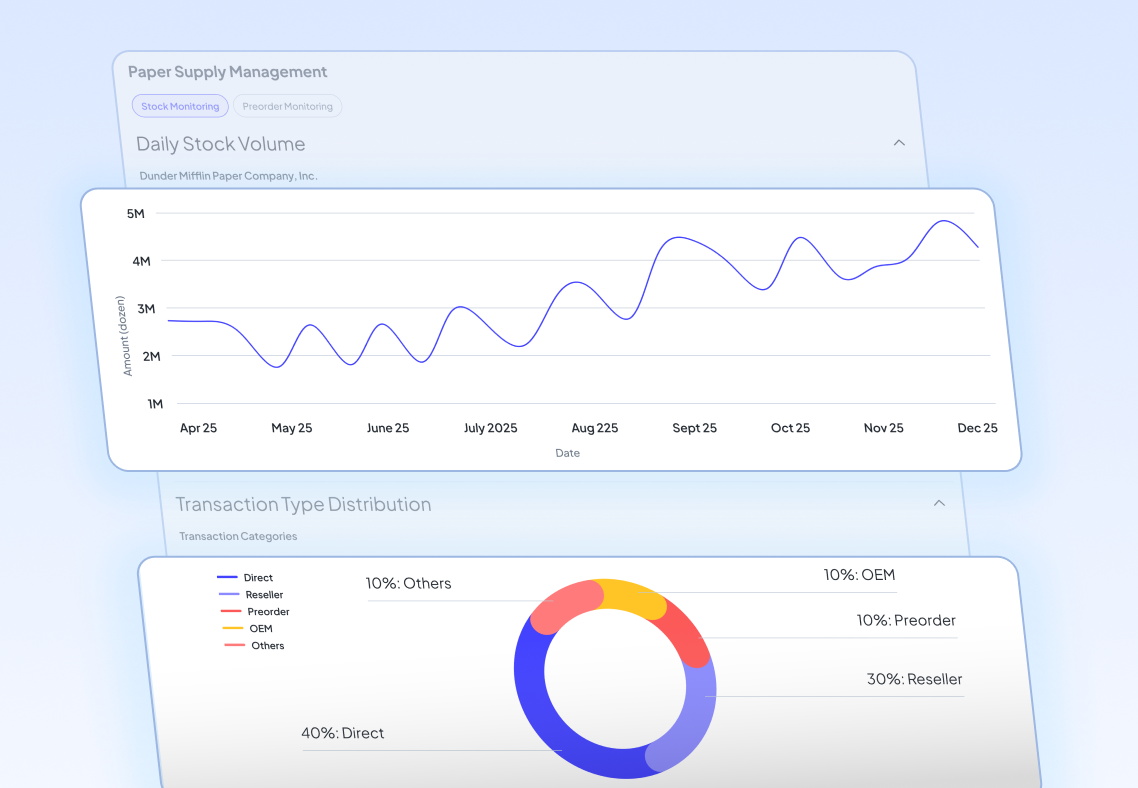

Retail & Supply Chain

Master Your Vendor Invoices

Reconcile thousands of delivery orders and invoices across multiple stores without the manual overhead. Fintelite handles varied layouts from different vendors effortlessly.

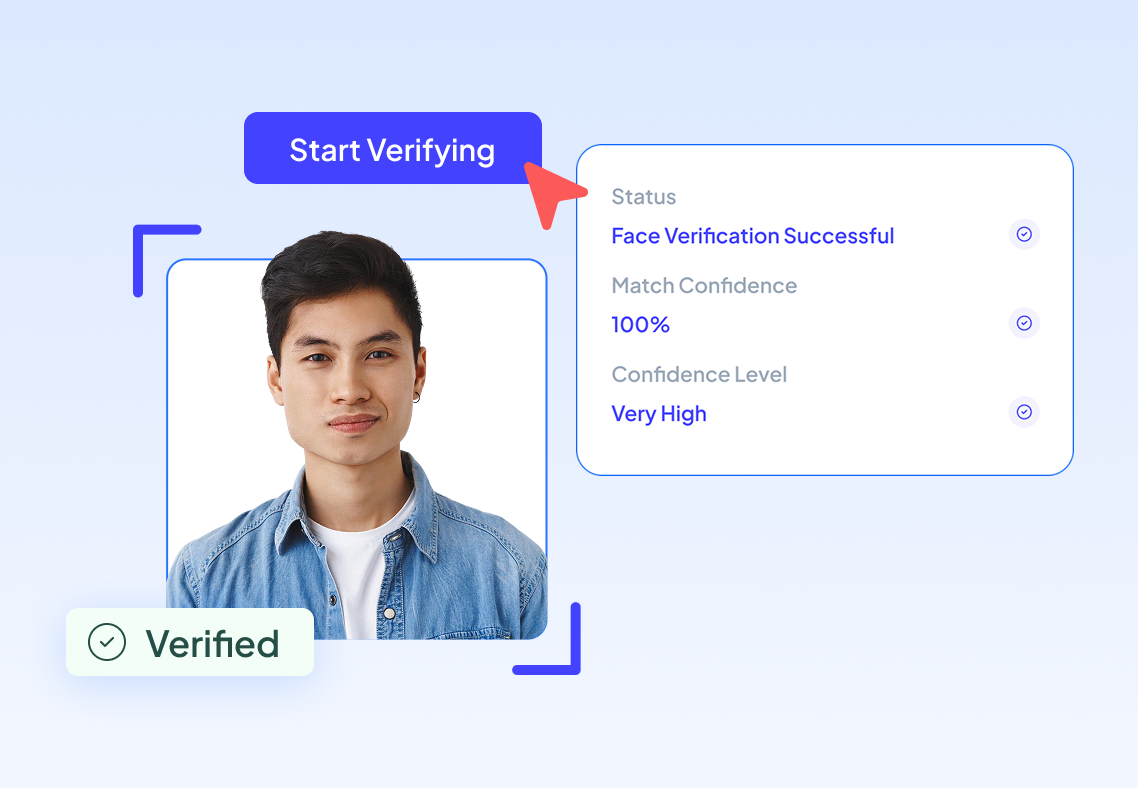

Government

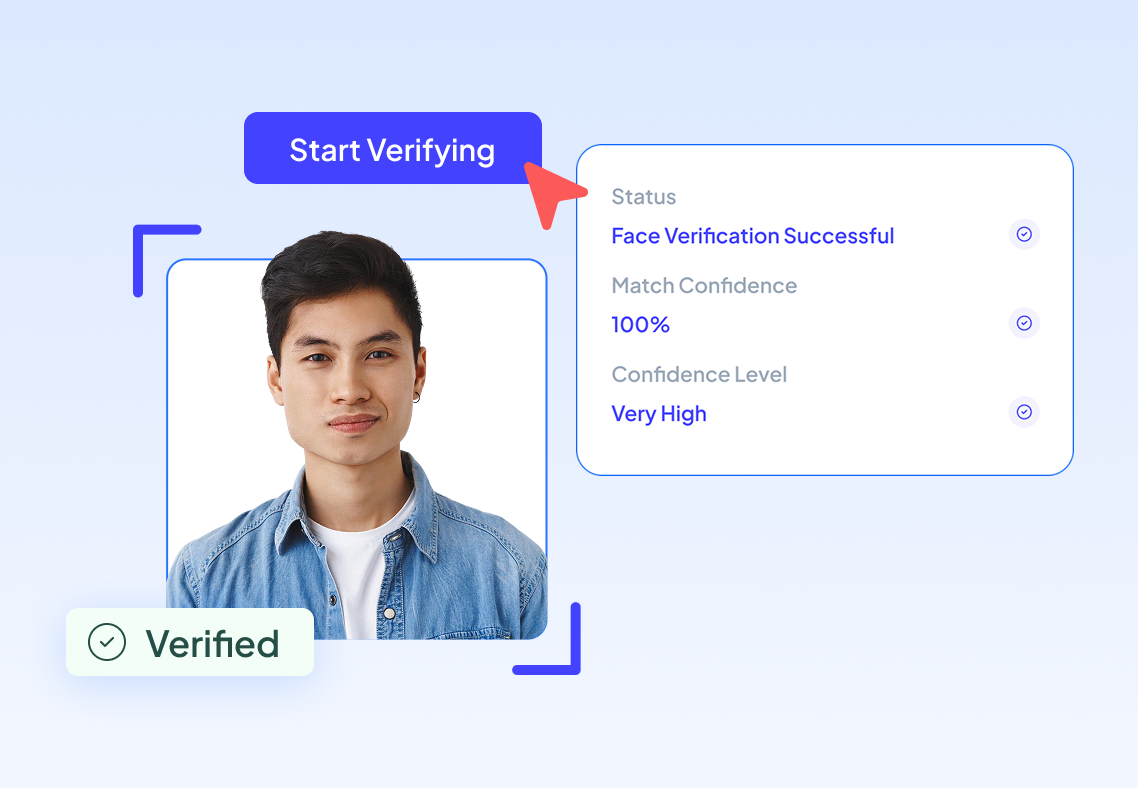

Transform decades of paperwork into searchable, structured data without compromising security. We securely process legal documents, regulatory filings, and official IDs with enterprise-grade AI.

Government

Transform decades of paperwork into searchable, structured data without compromising security. We securely process legal documents, regulatory filings, and official IDs with enterprise-grade AI.

Have a specific use case?

Our team is always just a click away

to help you find the right solution.

Our News

Fintelite Selected as Indonesia’s Only Company for the 8th Global FinTech Hackelerator in Singapore

12 June, 2025

Fintelite Collaborates with Openbank to Enhance Loan Processing for Rural and Cooperative Banks

26 June, 2025

Introducing Fintelite AI Document Solutions for Smarter Lending at the Dubai Fintech Summit 2024

26 June, 2025

Ready for an AI-upgrade to your business document processing?

There’s more to Fintelite AI. Schedule a demo at your convenience and see how our AI-powered document automation works in practice.

Ready for an AI-upgrade to your business document processing?

There’s more to Fintelite AI. Schedule a demo at your convenience and see how our AI-powered document automation works in practice.