Singapore OCR Bank Statements for Smarter Financial Data Processing

Bank statement processing in Singapore, whether during mortgage or loan underwriting, has one common challenge. It is time-consuming, involving repetitive manual steps. But with OCR

Bank statement processing in Singapore, whether during mortgage or loan underwriting, has one common challenge. It is time-consuming, involving repetitive manual steps. But with OCR

Bank statements are considered one of the most complex document types to process because they typically consist of multiple pages and large volumes of numerical

In today’s digital age, the need for efficiency in business operations is critical to achieving business goals. With over 1.1 million industries established in Malaysia,

Document verification is an essential aspect of Malaysian business operations, whether it’s for KYC (Know Your Customer) or KYB (Know Your Business). Without the process

Today, Indonesian online OCR tools are widely available, but not all of them are ideal for business. The first important factor to consider when choosing

A credit report is an important document in Australia that is typically required for loan or mortgage applications. In Australia, credit reports are primarily generated

Despite increasingly advanced technology, many businesses in Malaysia still heavily rely on time-consuming manual data entry. The most common reasons why businesses continue to invest

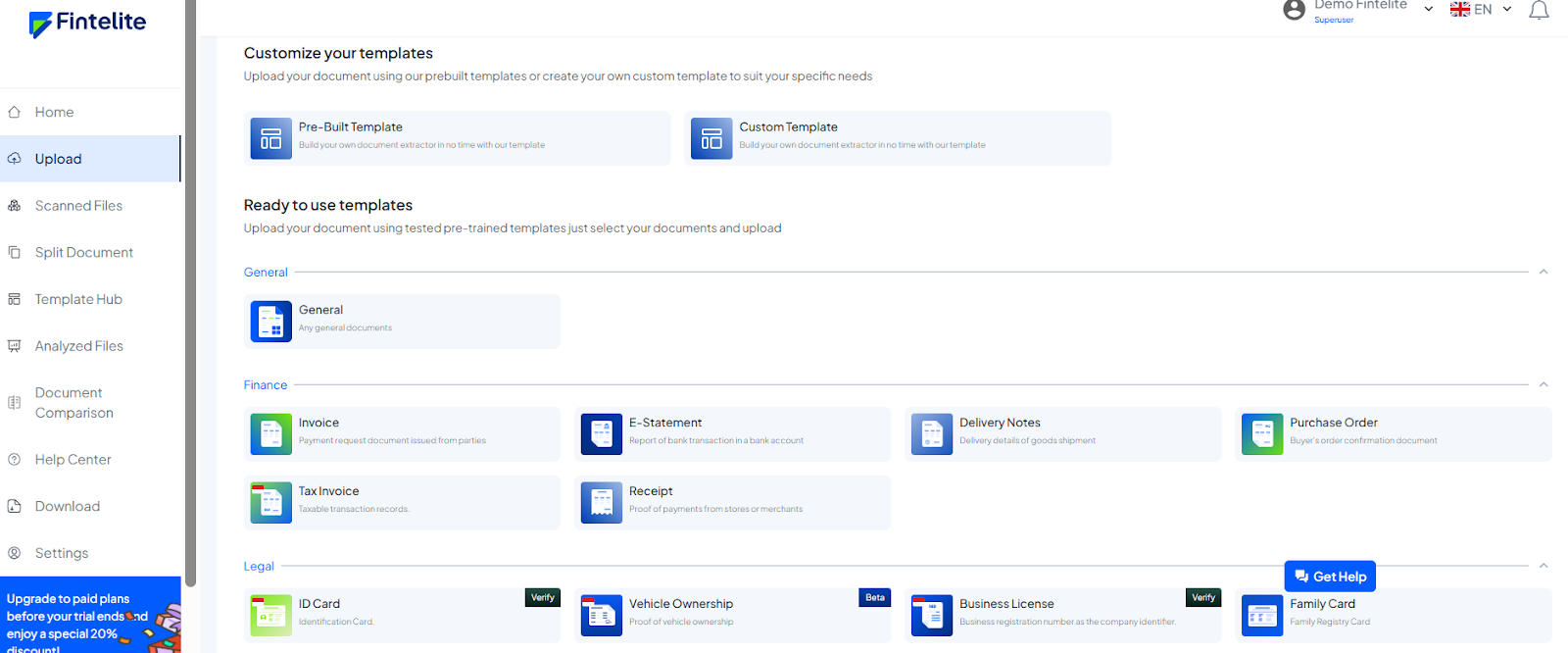

Wondering how to skip the hassle of manually typing data into the system? Good news, OCR (Optical Character Recognition) has made it possible. This technology

Bank statement automation is being assessed to help industries optimize their operations and examine customer data, especially during the underwriting process. Underwriting is an important

Behind an efficient business is a seamless operational workflow, where technology like OCR is utilized to make document processing faster and smoother. OCR (Optical Character