KYC application forms are commonly found during the initial phase of a service. In addition to identification documents, a person is also typically required to fill in and submit KYC application forms to enable the service provider to confirm their identity. However, the more customers sign up, the more KYC application forms to assess. At the same time, processing this type of document in high volumes can be challenging. This is where automated data extraction is needed to help lighten the workload and speed up the process.

With the right tool, automatically capturing every information in KYC application forms is no longer impossible. But what tool can be used? How does it work? Read on this article to find out the complete guide.

What Are KYC Application Forms

KYC is short for Know-Your-Customer. Thus, KYC application forms aim to gather essential personal information from customers, such as identification details, contact number, and address. Many companies use KYC application forms as part of their customer registration processes. For example, in banks, this document is used when a new customer wants to open an account or apply for a financing program. Companies should implement proper processes to handle these documents efficiently, one of which is by automating its data extraction.

Why Should You Use OCR Technology for Automation

When considering a tool for automating data extraction from documents like KYC application forms, Optical Character Recognition (OCR) technology is the ideal solution. OCR is a technology that is now widely available and leveraged to simplify document processing. It is best known for its capability to quickly scan, read, and convert information from documents into editable and searchable data. For this case, all the information that customers have filled in by hand on KYC forms can be accurately extracted and digitized.

How to Automatically Extract Data from KYC Forms Using OCR

Now, let’s take a closer look at how this works in practice. This guide features Fintelite, which offers an intelligent OCR solution designed for helping businesses of all sizes replacing time-consuming manual document processes. Here’s a step-by-step guide on how to automatically extract data from documents using Fintelite.

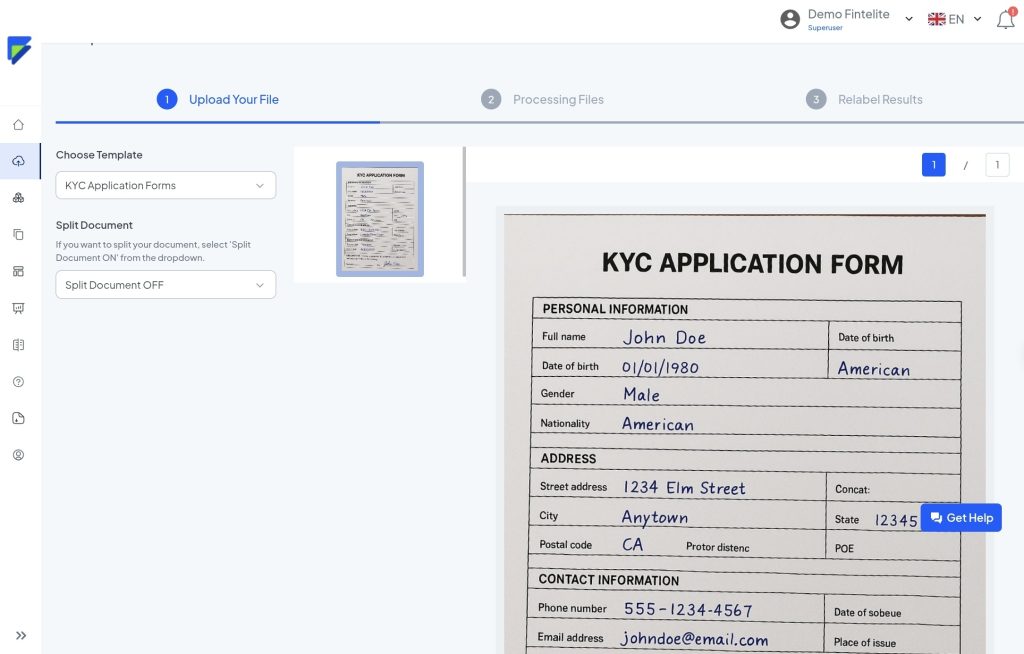

1. Document Upload

Start by uploading the file, either scanned images or in PDFs, into the Fintelite dashboard.

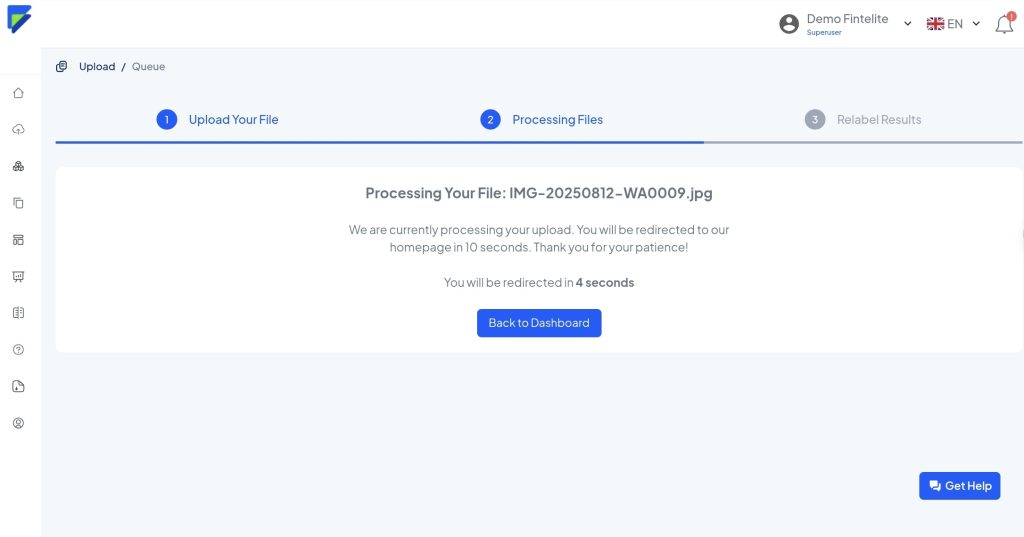

2. Data Extraction

Fintelite’s intelligent OCR technology accurately extracts every detail in the document, such as names, contact information, address, ID numbers, and service preferences.

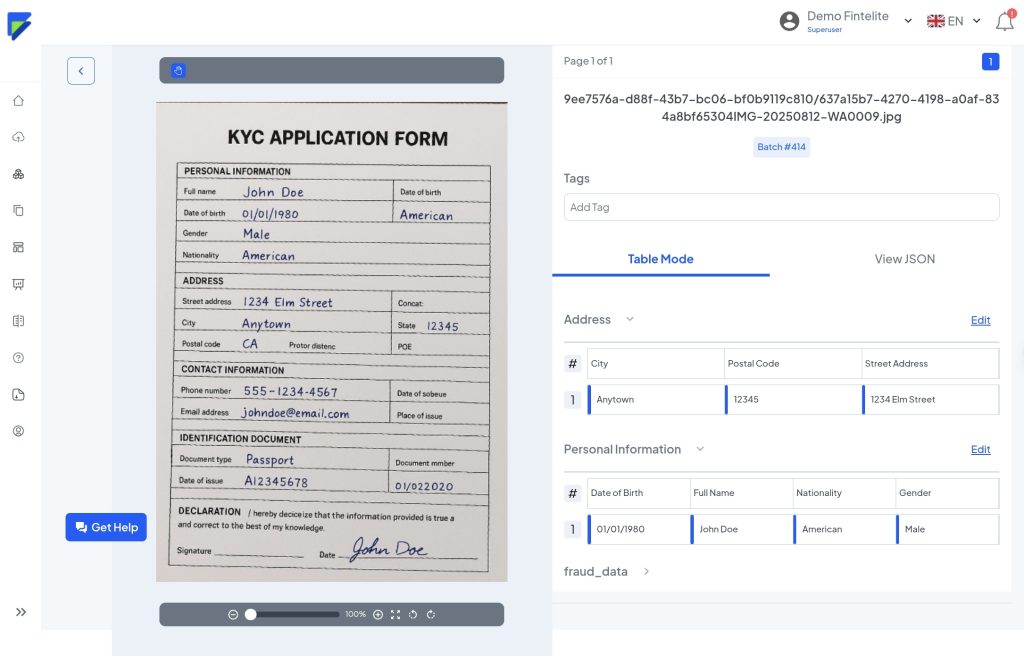

3. Result Preview

The extracted data is ready in an easy-to-review format, so you can do a quick check before finalizing the result.

4. Data Integration

Seamlessly deliver the data result into existing databases or customer management systems for further processing and archival.

Start Automating with Fintelite

Fintelite has been empowering companies to transform their document workflows for years, delivering OCR solutions that make document processing way more efficient. With its high level of accuracy, Fintelite ensures reliable data extraction from customer forms, minimizing KYC delays due to errors. Furthermore, it gives you full control to determine what specific data to extract and how you want it organized, aligning your company standard. At Fintelite, data privacy is a top priority, we ensure all customer information is securely handled throughout the process.

Let’s discuss your needs and discover how Fintelite can help your business.