Fraud risk in the mortgage industry remains a concern — and in fact, it is becoming a more serious problem as fake documents are now easier to create. A report highlighted that the Mortgage Application Fraud Risk Index from 2023 to 2024 has shown an 8,3% increase nationwide. It is a big number considering the significant financial loss this fraud can cause.

While document fraud risk is still rising, mortgage companies cannot just do nothing. An effective prevention strategy is required to keep the company protected from applicants with fraudulent intent. In this article, dive into the current situation of mortgage fraud and what your company can do to mitigate it.

Understanding Mortgage Fraud

Mortgage fraud is a type of fraud that targets loans for purchasing property, such as homes or land. It often involves the falsification of mortgage application documents, like bank statements, which typically play a crucial role in gaining loan approval. However, it has become more complex to detect, as it now involves multiple forms of document forgery to exploit gaps in the verification process.

Why Mortgage Fraud Is Harder to Detect

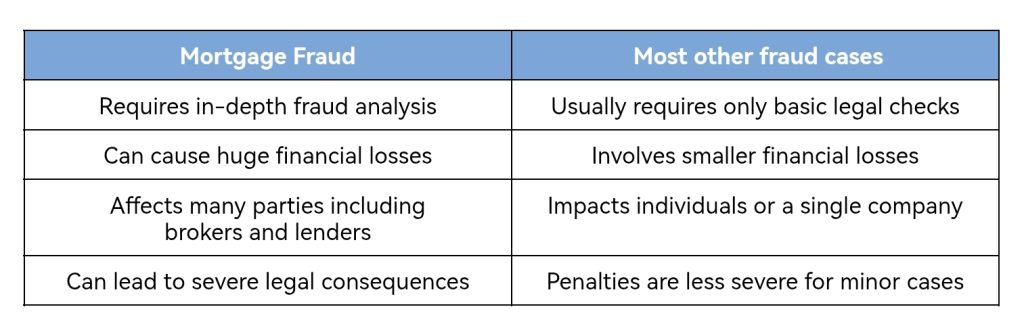

There is a wide range of documents during mortgage loan verification, which is why identifying fraud in this area requires more thorough investigation. To get a clearer understanding about this, let’s see how mortgage fraud compares to other types of fraud in most cases.

Effective Ways to Prevent and Stop Mortgage Fraud

Mortgage fraud is a growing risk, but with the right strategies, lenders can detect and prevent it before it starts.

- Establish a smarter KYC verification

KYC is the first step to confirm your client’s profile, including their identity, address, employment, and financial information. This is where strong verification plays a crucial role in identifying potential mortgage fraud at the earliest stage. Ensure the KYC process works optimally in screening applicants by integrating AML checks, updated risk models, and OCR for more accurate document data capture.

Read: What is OCR (Optical Character Recognition)?

- Implement a robust bank statement analysis

Bank statements, which often consist of hundreds of transaction entries or more, are among the most commonly manipulated documents. Leverage advanced technology to enhance bank statement analysis. Not only will this help you obtain a quick financial analysis, but it also helps detect anomalies and potential fraud that may go unnoticed during manual checks.

- Develop a mortgage fraud checklist

To help ensure no critical detail is overlooked, consider creating a checklist that breaks down key items to review as part of your fraud prevention process. By utilizing a checklist, employees can follow a more structured assessment flow and conduct internal reviews more efficiently.

- Train employees on the latest fraud practices

As fraud practices become more sophisticated, employees must stay alert and well-informed. Educate them on emerging fraud types and recent changes in tactics, especially those that impact the verification process. This can help your team to identify red flags and respond with confidence.

The Right Tool to Build a Stronger Fraud Defense

The future of mortgage lending is here. As technology rapidly advances, lenders have a powerful opportunity to strengthen the underwriting process through smarter bank statement analysis.Fintelite leverages AI technology to help lenders gain deeper financial insights from client’s bank statements in less time. From balance trends, cash flow patterns, to transaction behavior — every insight you need is captured and expertly analyzed. Fintelite’s Bank Statement Analyzer is also advanced by a cutting-edge fraud module to detect signs of irregular financial activities and potential document forgery, ensuring a more reliable underwriting process.

Ready to level up your bank statement processing? Schedule a demo and see Fintelite in action.