OCR (Optical Character Recognition) technology has driven a new trend for document automation. In accounts payable involving a large number of invoices to process, OCR can be a game changer. It takes over repetitive tasks by automating data capture of invoices, so that the finance team can move faster to what’s next. The implementation of OCR for accounts payable helps streamline financial workflows; however, many businesses are still not fully aware of how effectively it can reduce invoice processing delays and errors.

In this guiding article, we will walk you through how OCR technology transforms accounts payable and the powerful benefits that make it important for your business.

What is OCR for Accounts Payable

Fundamentally, OCR (Optical Character Recognition) is a technology that converts data in documents or images into a searchable and editable format. For accounts payable, OCR is designed to automatically extract key fields from invoices, making it fully usable for the accounting team to process. Information that can be extracted includes vendor name, invoice number and date, line item details, quantities, prices, tax amounts, and total payable. OCR can also be used to capture data from purchase orders for two-way matching, where the invoice details are compared against the purchase order to ensure consistency.

Read also: How to Automate Invoice Matching Process

Why Your Business Needs OCR for Accounts Payable

For businesses looking to streamline accounts payable, OCR is not only a solution, but a strategic decision, here’s why:

Improve competitive edge

In today’s business landscape where speed and accuracy are key, manual data entry during accounts payable is already outdated. OCR is paving the way for finance teams to keep up with digital transformation and gain a competitive edge through smarter financial operations.

Reduce delays and errors

Manual errors are costly and cause the process to take even longer. By automatically capturing key information from invoices and feeding it into your system directly, it can help you speed up processing times while minimizing the risk of missed entries.

OCR built for scale

OCR efficiently processes the growing volume of documents that businesses need to handle over time. It seamlessly adapts to increased workloads while always ensuring consistent performance and accuracy.

Read also: Still Using Manual Data Entry? Here’s Why It’s Bad for Your Business

The Role of OCR in Powering Accounts Payable

Most organizations integrate OCR into the data entry stage of the accounts payable. Here’s how OCR plays a crucial role in transforming the typically long accounts payable workflow into a simpler and more efficient process.

Automate invoices scanning & capture

Invoices received whether in printed paper or digital PDF. With OCR, data from all invoices can be accurately extracted, so that the finance team can quickly get the payment information they need to input and process.

Automate purchase orders scanning & capture

By automating data extraction from purchase orders, OCR enables easier matching between billed items and ordered items, minimizing discrepancies while reducing manual checking process.

Seamlessly send the data to your system

The combination of OCR and AI maximizes the automation of invoice processing by seamlessly integrating the extracted data into the digital accounts payable process. It helps the finance team to process invoices faster and make timely payments.

People Also Asked

1. Can OCR handle different types of invoices?

The advanced version of OCR is now comes with intelligent recognition capabilities that learns every newly inputted invoice. By seamlessly processing invoices from various vendors, OCR ensures smooth invoice processing for faster accounts payable.

2. How do we choose the right OCR for accounts payable?

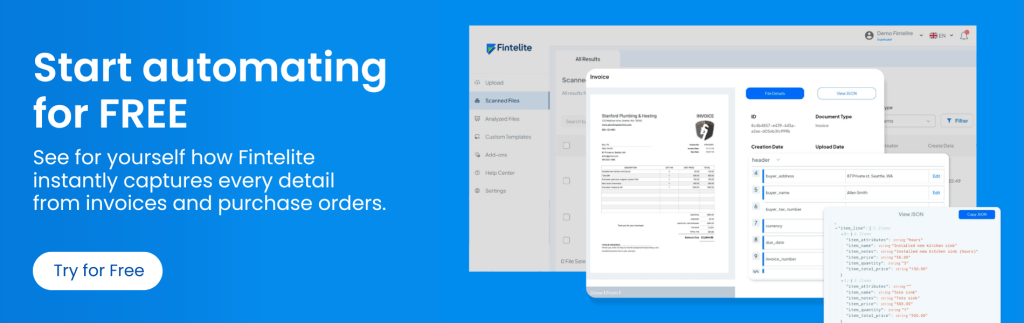

To achieve the most optimal results, consider using an AI-powered OCR designed for financial documents like Fintelite. With industry-specific OCR model, it recognizes numerical data with higher accuracy than common basic OCR tools. Also, do not ignore data privacy. Fintelite takes data security seriously, providing reliable service that complies with global ISO 27001 security standards.

3. How can we implement OCR to our existing workflow?

At Fintelite, there are two ways to automate with OCR. Using ready-to-use dashboard or integration via API. For businesses that already have established systems or applications, API integration offers a seamless way to embed Fintelite’s OCR capabilities directly into your existing workflow.