As we know, loan processing means collecting, validating, and reviewing multiple documents. Manual handling of loan documents has long posed operational and resource challenges for banks and financial service institutions. But with OCR technology, this once laborious process has been transformed. It provides a powerful solution for automating loan document extraction, enabling data from all required documents to be swiftly extracted and transferred to the underwriting system.

In this blog, we’ll deep dive into how OCR improves loan processing efficiency and explore use case examples for using it efficiently.

Understanding OCR

OCR stands for Optical Character Recognition, a technology that converts handwritten or printed text from images or documents into machine-readable datasets. To simply put, OCR allows you to collect applicant data faster by automatically reading and converting information extracted from documents into the format that your system can process. With OCR automation as part of your workflow, significantly reduce manual data entry, minimize errors, and shorten processing times.

How OCR Works in Loan Processing

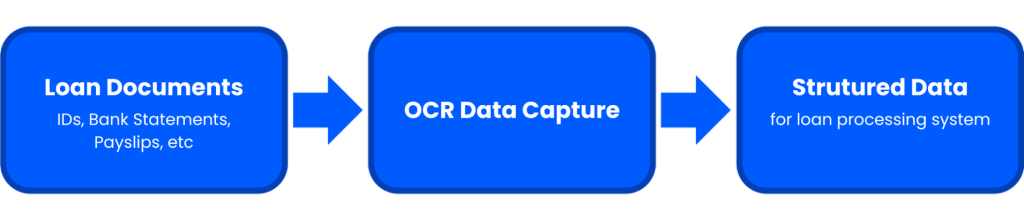

At the input stage, OCR receives documents submitted by applicants, such as identity proofs, salary slips, tax returns, and bank statements. These files may be scanned copies, photos, or digital PDFs from multiple sources.

During processing, the OCR system intelligently scans, reads, and extracts important information like applicant details, income, and transaction data.

As the output, the captured data formed into structured information then can be integrated into loan workflows, supporting automated underwriting, risk assessment, and quicker loan approvals.

OCR Use Cases in Loan Processing

Automated Form Intake

Initially, applicants are required to complete a loan application form. OCR can help automatically collect all the information filled in the form, seamlessly transferring it downstream into your customer database. With OCR, reduce the reliance on manual entry that is very time-consuming and often causes delayed response times.

Identity Verification

Put OCR in the identity verification process to extract personal details from identification documents submitted, such as names, dates of birth, and ID numbers. Switching to OCR helps you reduce manual mistakes during data input and enables a more accurate and faster validation of customer identities against official systems.

Bank Statement Analysis

One of the loan documents that takes the longest to evaluate is a bank statement. Instead of formatting bank statement data manually, leverage OCR to automatically extract transaction records from bank statements. It reads transaction histories, balances, and account details from bank statements, making the data immediately accessible for required assessment.

Read also: How to Automate Bank Statement with AI Securely

OCR Benefits in Loan Processing

Investing in OCR technology comes with various benefits that can increase overall loan processing efficiency, such as:

- Faster SLA: Automates data extraction to significantly reduce document review and loan processing time.

- Improved Accuracy: Minimizes manual entry errors by capturing data directly from source documents.

- Cost-Efficient Operations: Optimize operational efficiency by reducing manual workloads and enabling teams to focus on higher-value tasks.

- Scalability: Efficiently handles large volumes of loan applications without compromising performance.

- Better Compliance: Creates consistent, auditable data records to support regulatory requirements.

Conclusion: Accelerate Loan Processing with AI-Powered OCR

With an advanced AI-powered OCR solution, loan processing can be transformed by automating data extraction from all essential applicant documents, including identity, legal, and financial records. AI OCR leverages advanced recognition capabilities to maintain high accuracy when reading data across the diverse document types commonly required when evaluating loans.

Fintelite stands as a scalable AI OCR solution designed for businesses. Seamlessly integrate Fintelite AI OCR to speed up data collection in loan applications, enabling quick data extraction into structured datasets format compatible with your system. To meet your processing standards, you can configure tailored data extraction rules through an easy, no-code setup.