Smartly Analyze Bank Statements in Hours Minutes

- Transform raw transaction record into decision-ready report

- Built-in Fraud Detector for advanced assessment

- Customizable analysis that adapts to your needs

AI-Powered Analysis and Fraud Detection in One Platform

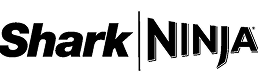

One-click bank statement summaries

Unlock insights on expense behavior, balance trends, cash-flow patterns, and detailed transaction summaries with just one simple upload.

- Accepts various bank statement formats

- No more hassle from manual review and analysis

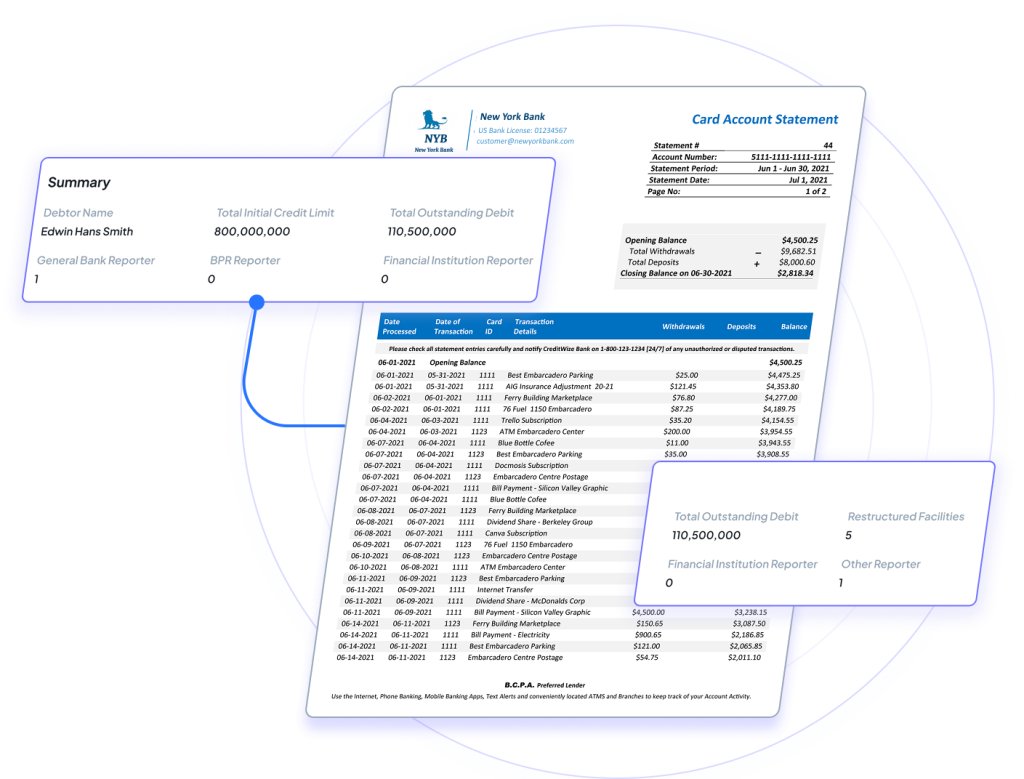

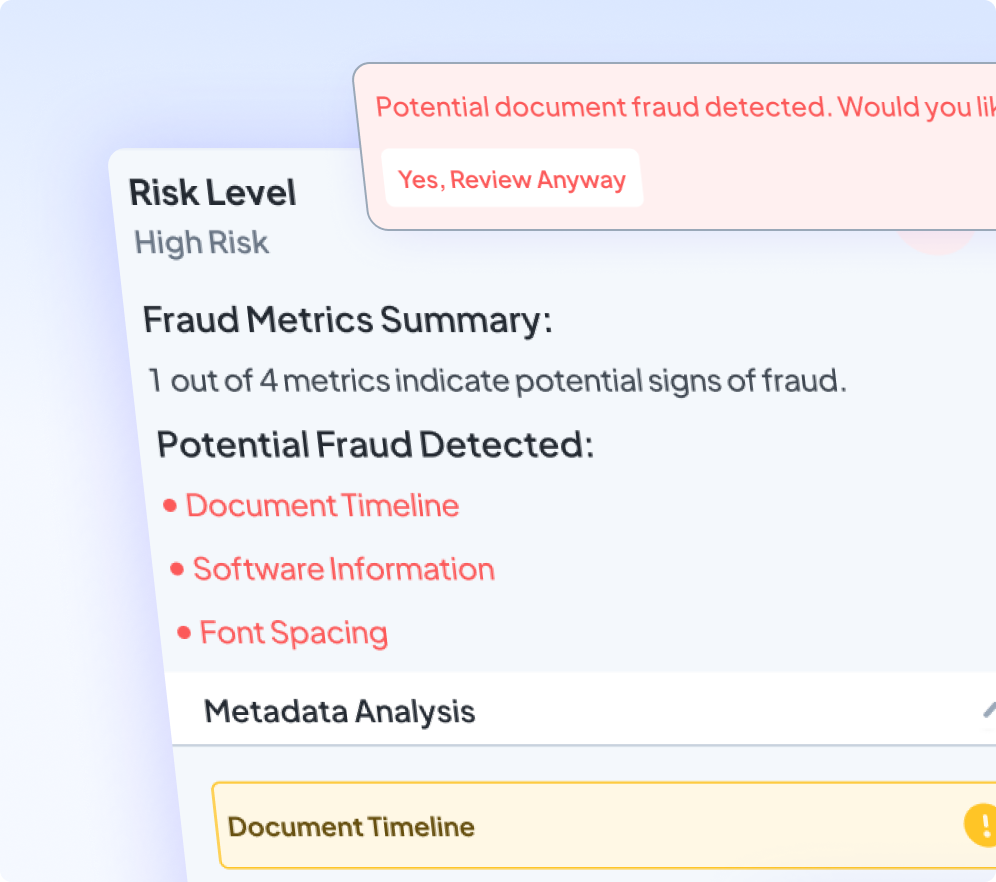

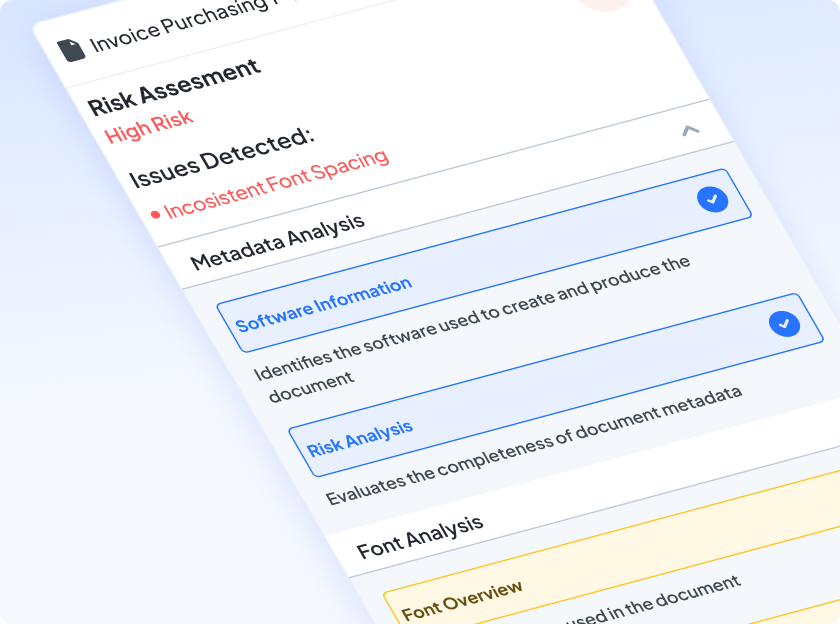

Never miss a sign of fraud

Use our embedded AI-powered fraud detection to spot hidden edits and suspicious transaction activity with maximum ease.

- Configurable detection rules

- Complete checks on document integrity and transaction history

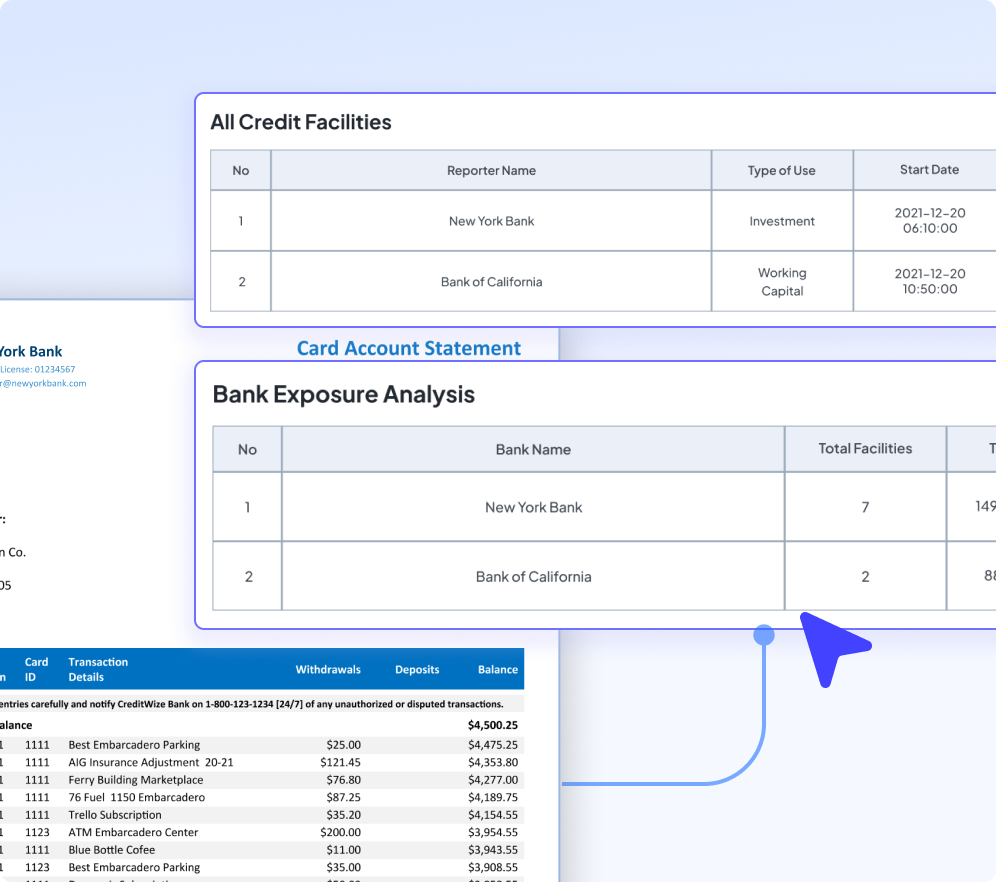

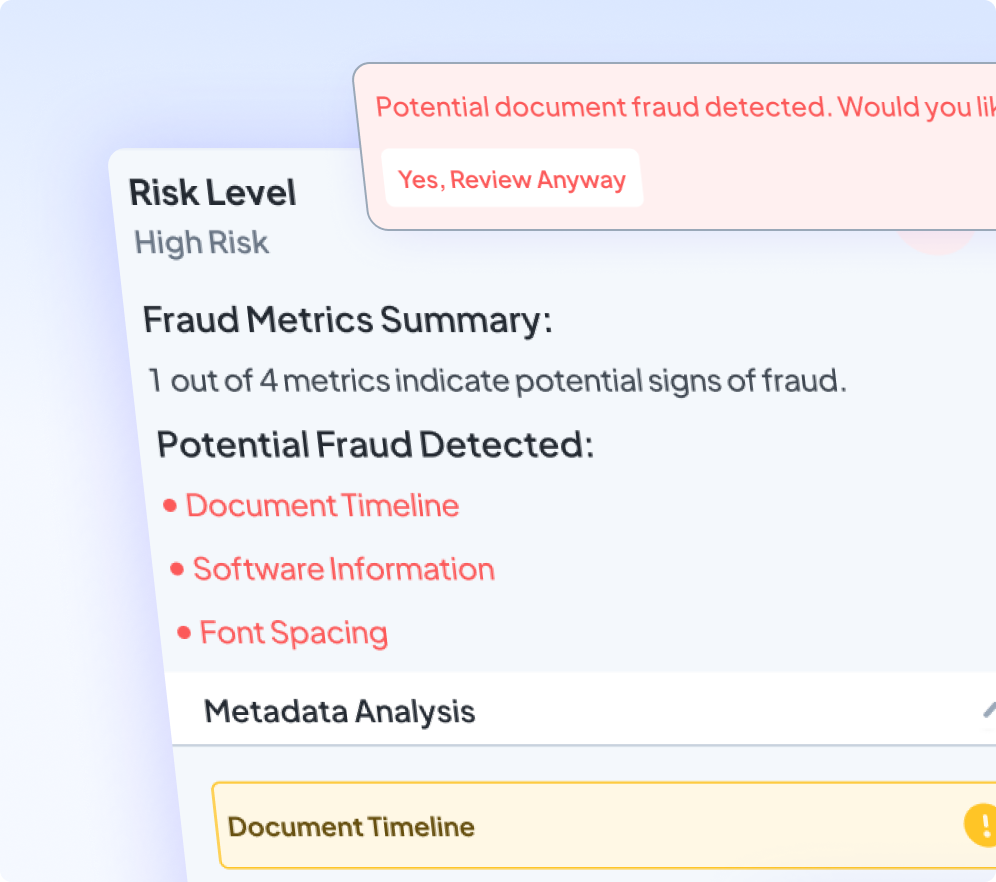

Customize what matters for you

Take full control of which aspects you want to check and when fraud should be flagged, aligning with your assessment standards.

- No-code customization

- Fast and easy setup

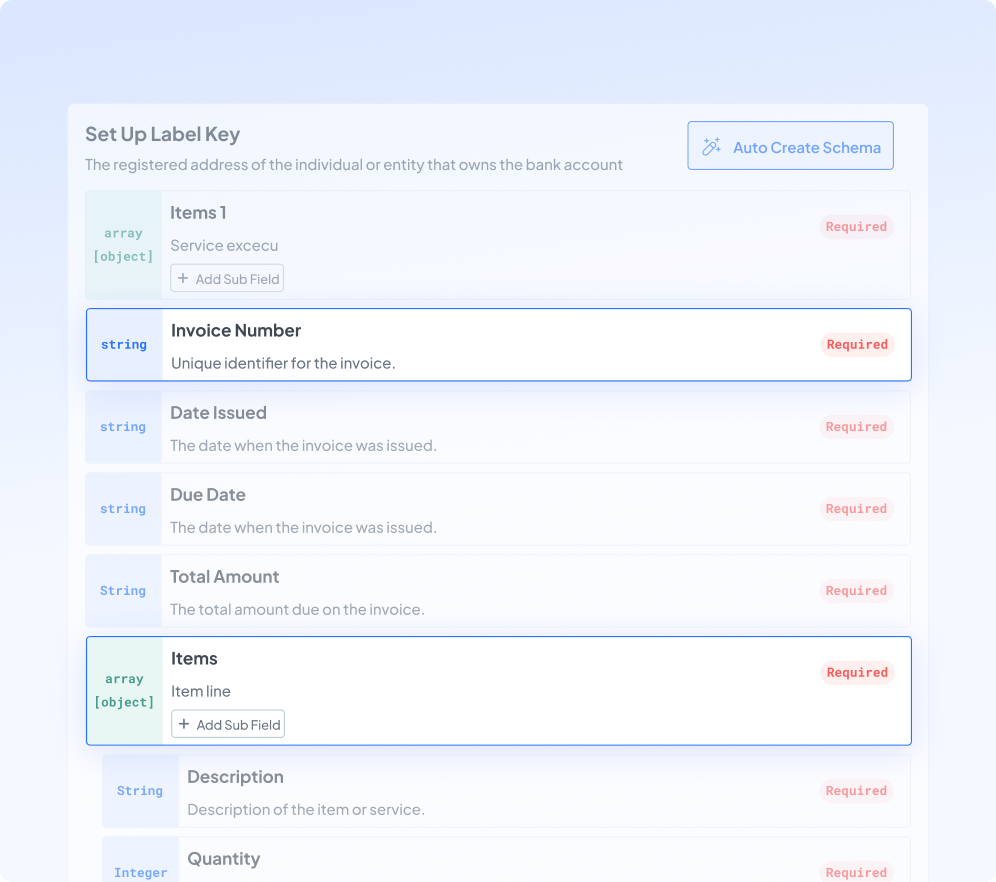

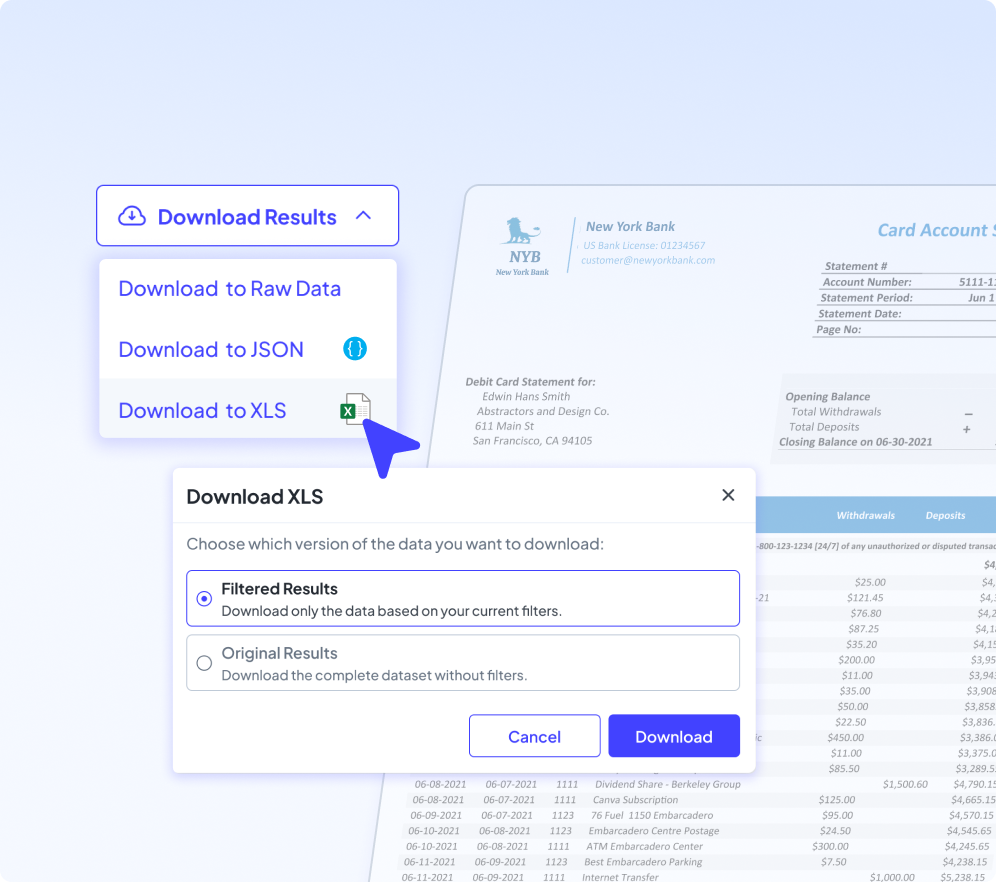

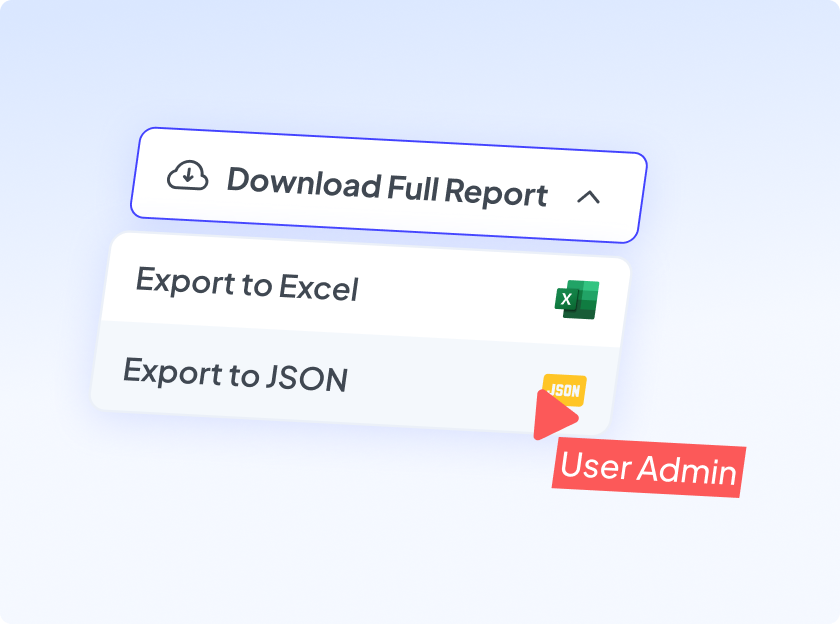

Get shareable reports instantly

Easily generate and export full analysis results as an Excel or PDF report for further use and decision-making.

- Customizable reporting template

- Support integration to other systems

How it Works?

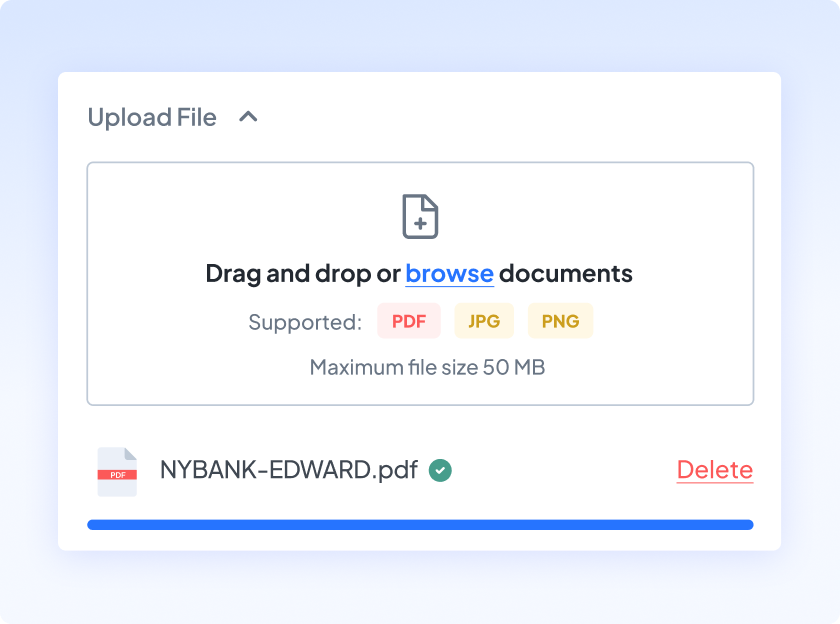

Upload or Ingest Documents

Submit bank statements to automatically starts the data extraction process.

Smart Analysis & Fraud Screening

Our AI analyzes transaction records and detects any behavior that indicates fraud, all based on the customizations you’ve set.

Seamless Integration & Insights

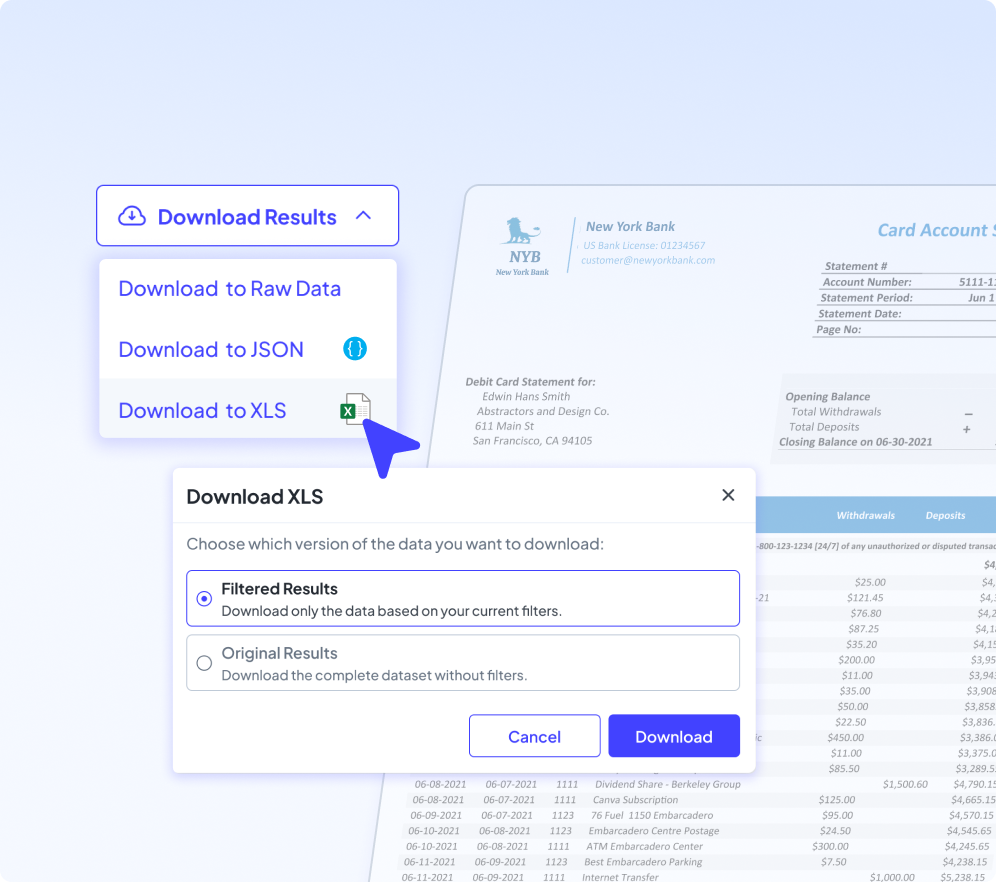

Download results in XLS or PDF formats or export directly to your underwriting or processing system.

Two Ways to Automate

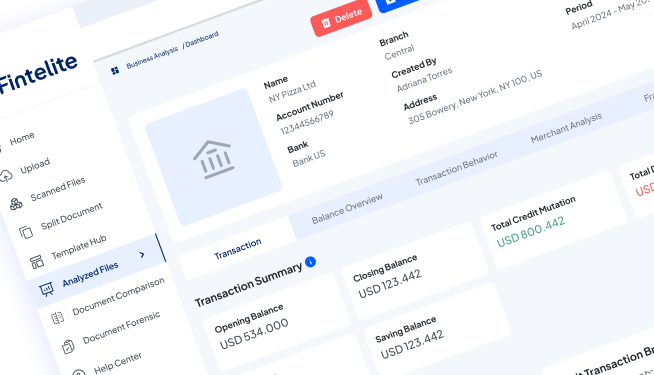

Ready-To-Go Dashboard

All you need is simply upload the document, and our AI will transform it into structured data in seconds. Designed for everyday use, without technical efforts needed.

Ideal for: finance ops, compliance, back-office teams.

Integrate via API

For full customization, choose our developer- friendly API buit for scale. Delivering JSON results, confidence scores, and schema flexibility that seamlessly fits your workflow.

Ideal for: lending, fintech, banking, platform teams.

Use Cases: Automated Bank Statement Analysis Across Industries

Banks and Lending

Improve lending efficiency by automating in-depth bank statement analysis, enabling faster and more reliable credit risk assessment.

Insurance

Process claims faster with AI that analyzes transaction histories to validate financial activity and detect inconsistencies instantly.

Finance and Accounting

Eliminate manual bottlenecks in preparing regular financial reporting and audit with automated bank statement analysis that saves you hours.

Real Estate and Property

Verify tenant income, cash flow stability, and payment reliability by automatically analyzing bank statements during rental applications and lease renewals.

Frequently Asked Questions

Fintelite is powered by AI that seamlessly adapts to different designs and layouts, allowing you to process any bank statement you need without manual setup or template configuration.

Once bank statement analysis is complete, you can explore the results on an intuitive dashboard and export them in your preferred format after reviewing and confirming the results.

At Fintelite, data privacy is our top priority. All bank statement data are protected with encryption, never stored, and processed via flexible cloud deployment options according to your business preference.

Schedule a Free Demo with Fintelite

Get the right solution for your specific needs. Simply fill out the form and pick a time that works best for you.

Schedule a Free Demo with Fintelite

Get the right solution for your specific needs. Simply fill out the form and pick a time that works best for you.

News

Fintelite Selected as Indonesia’s Only Company for the 8th Global FinTech Hackelerator in Singapore

12 June, 2025

Fintelite Collaborates with Openbank to Enhance Loan Processing for Rural and Cooperative Banks

26 June, 2025