AI-Powered Data Extraction and Fraud Detection Beyond Human Capability

- Process unstructured and complex documents 10× faster with over 90% accuracy

- Detect any signs of fraud and provide configurable fraud rules

- Seamless integration to your system

Document Processing Made Effortless

Auto-capture data in under 60 seconds

Automatically scan, extract, and convert unstructured documents into structured dataset, just by uploading.

- Supports any type of documents

- Reduce turnaround time and manual errors

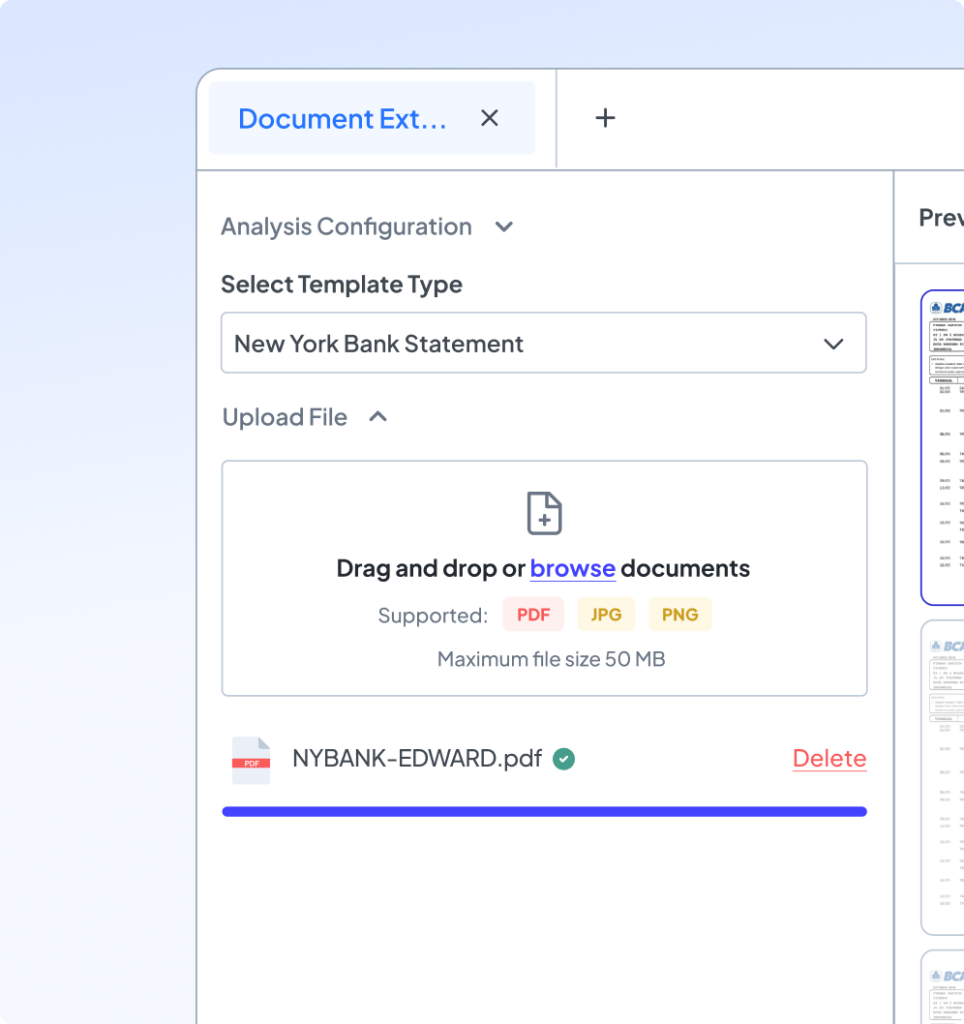

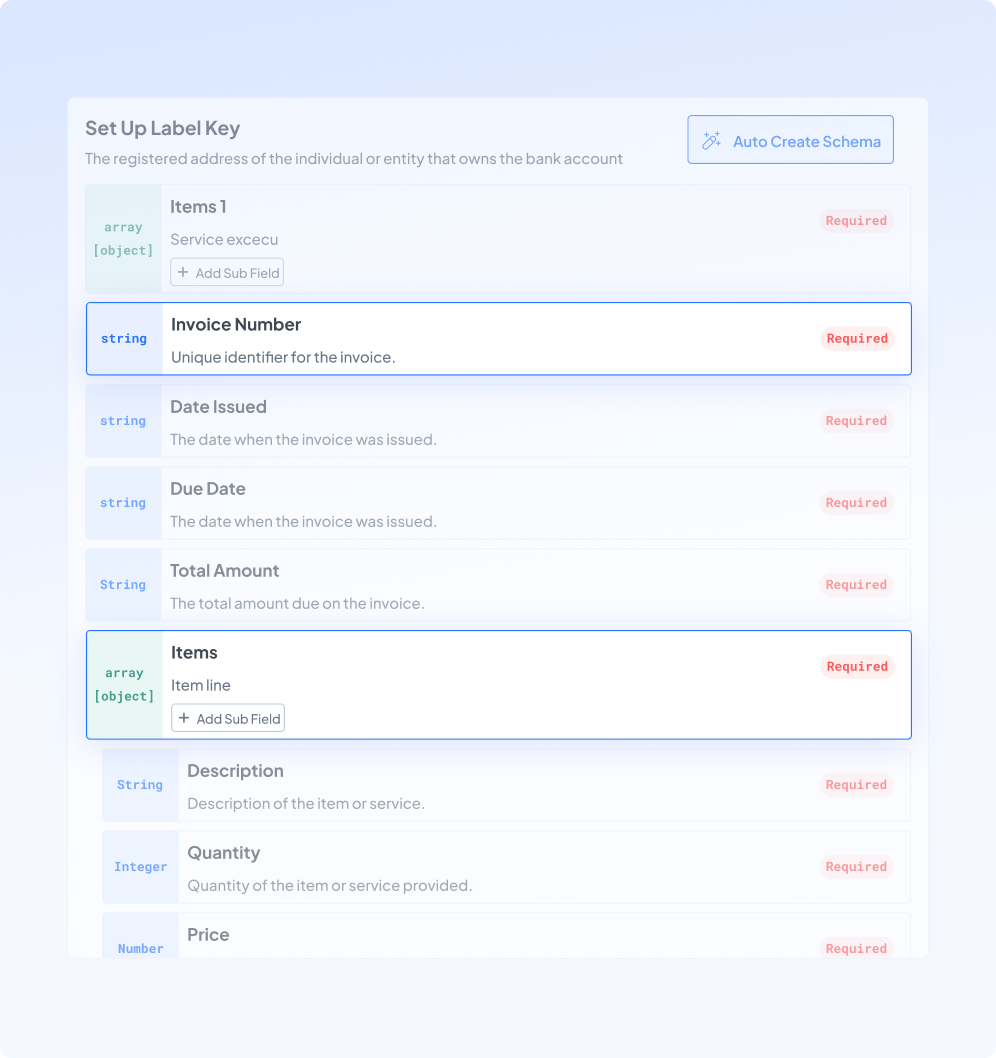

Fully customizable data extraction

Extract only the data you need by adjusting our pre-defined templates or creating new templates from scratch.

- Various adjustable document type templates

- No-code, fast, and easy setup

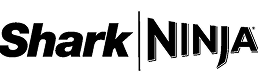

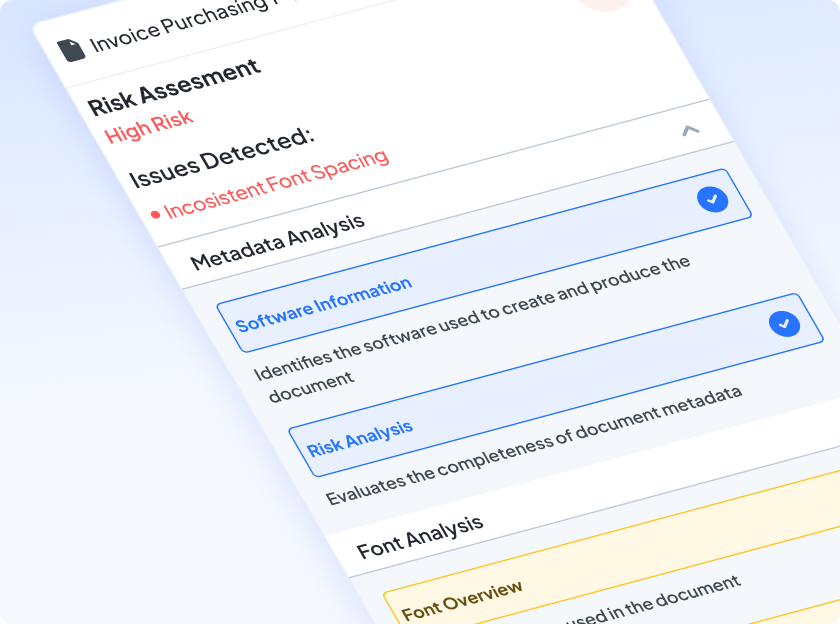

Stay alert with any possible document fraud

Our fraud detection combines AI's advanced capability and deep learning to uncover document tampering and falsification instantly.

- Early warning system

- Configurable fraud and validation rules

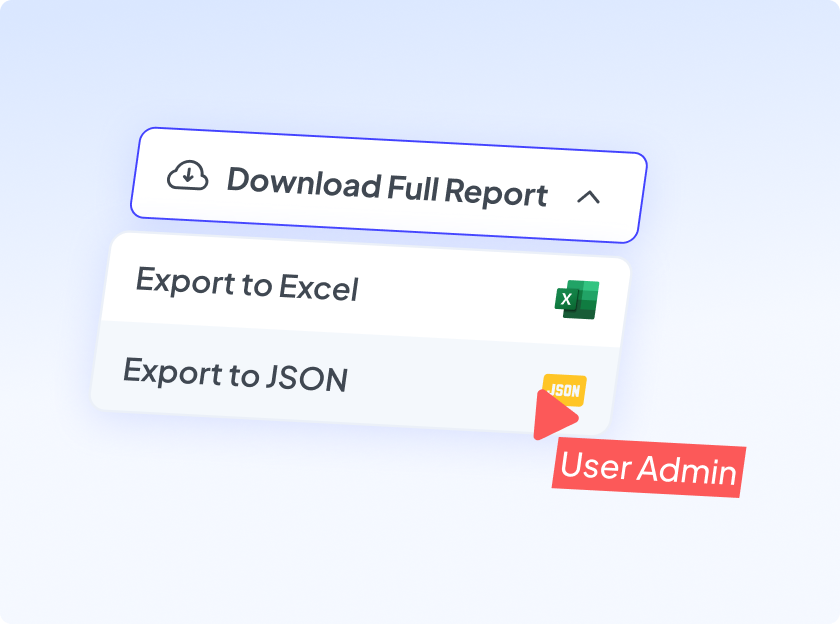

Custom reporting tailored to your needs

Generate structured insights and results that match your existing standard, no need for manual reformatting and ensure seamless integration with your ERP, CRM, or other systems.

- Automated structured reporting with pre-built templates

- Customizable outputs with our OCR builder

How it Works?

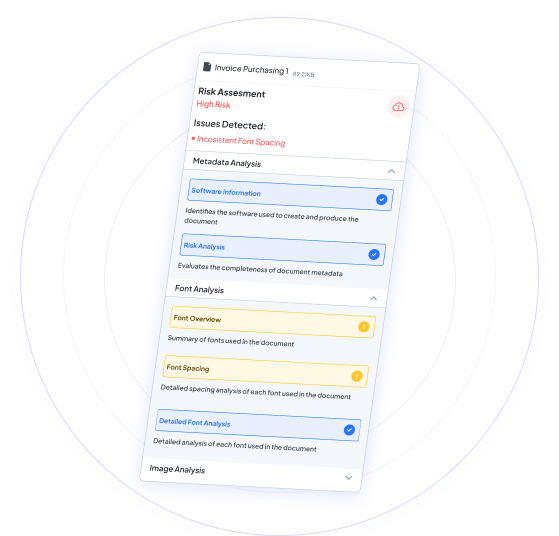

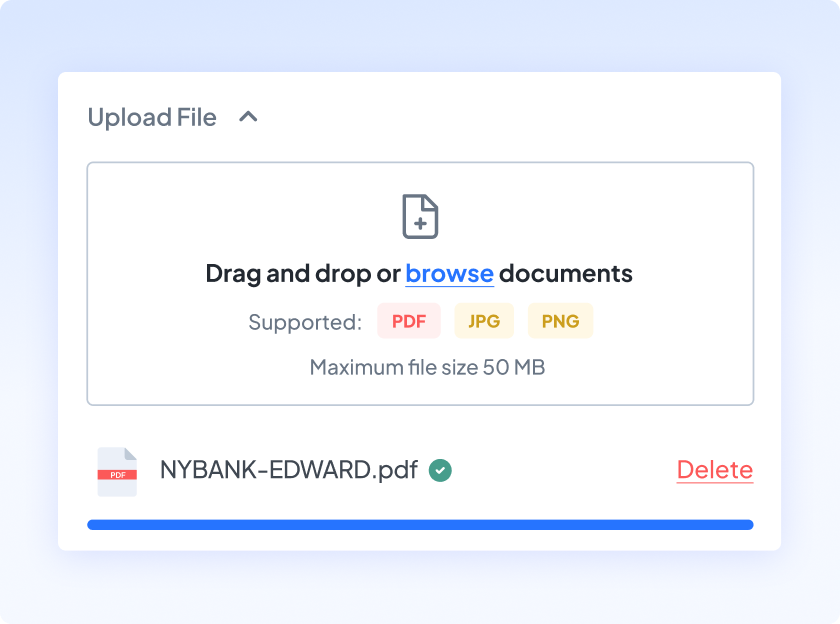

Upload or Ingest Documents

Submit invoices, bank statements, loan applications, and other structured or unstructured documents.

OCR and Fraud Detection

Our AI reads and extracts data with high accuracy while detecting even the smallest signs of fraud.

Seamless Integration & Insights

Easily download results as XLS, JSON, or TXT, or export directly to your ERP, CRM, or underwriting system.

Two Ways to Automate

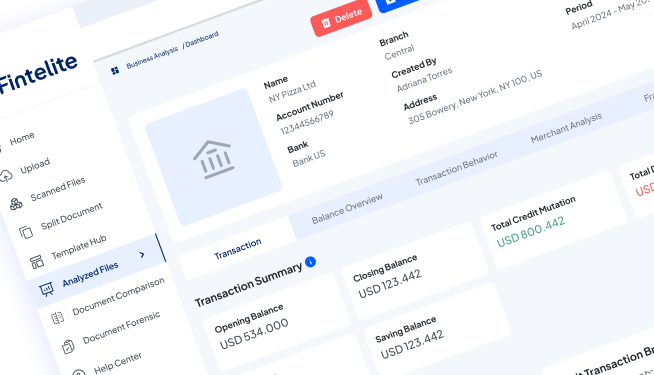

Ready-To-Go Dashboard

All you need is simply upload the document, and our AI will transform it into structured data in seconds. Designed for everyday use, without technical efforts needed.

Ideal for: finance ops, compliance, back-office teams.

Integrate via API

For full customization, choose our developer- friendly API buit for scale. Delivering JSON results, confidence scores, and schema flexibility that seamlessly fits your workflow.

Ideal for: lending, fintech, banking, platform teams.

Use Cases: AI-Powered Document Processing Across Industries

Lending

Automate KYC & credit risk assessment. Extract, validate, and analyze borrower data from applications, KYC documents, and bank statements in seconds

Insurance

Accelerate claims processing with AI-driven fraud detection. automate data capture and verification from medical reports to policy documents.

Finance and Accounting

Automate invoice processing & expense management Detect anomalies in financial statements and transactions with unmatched accuracy.

Healthcare

Focus on patients, not paperwork. Automate records, insurance claims, and reports to ensure faster processes and seamless healthcare services.

Frequently Asked Questions

Fintelite supports a wide range of documents, including invoices, bank statements, loan applications, insurance claims, and more, in any format. We also provide custom templates to ensure accurate extraction tailored to your specific document types.

Fintelite works with documents in any language. It analyzes each document’s content and structure to extract data efficiently and accurately, while flagging irregularities or potential fraud.

Fintelite can process large volumes of documents faster with high accuracy. Tasks that normally take days can be completed in just hours, significantly saving your time.

Schedule a Free Demo with Fintelite

Get the right solution for your specific needs. Simply fill out the form and pick a time that works best for you.

Schedule a Free Demo with Fintelite

Get the right solution for your specific needs. Simply fill out the form and pick a time that works best for you.

News

Fintelite Selected as Indonesia’s Only Company for the 8th Global FinTech Hackelerator in Singapore

12 June, 2025

Fintelite Collaborates with Openbank to Enhance Loan Processing for Rural and Cooperative Banks

26 June, 2025